Sigtech

We help clients achieve measurable results

$5T

Our clients oversee a combined AuM of $5 trillion

Speed

Streamline and accelerate your research using our strategy building blocks

Trusted

Replicate your real-world trading environment with our event-driven backtesting engine

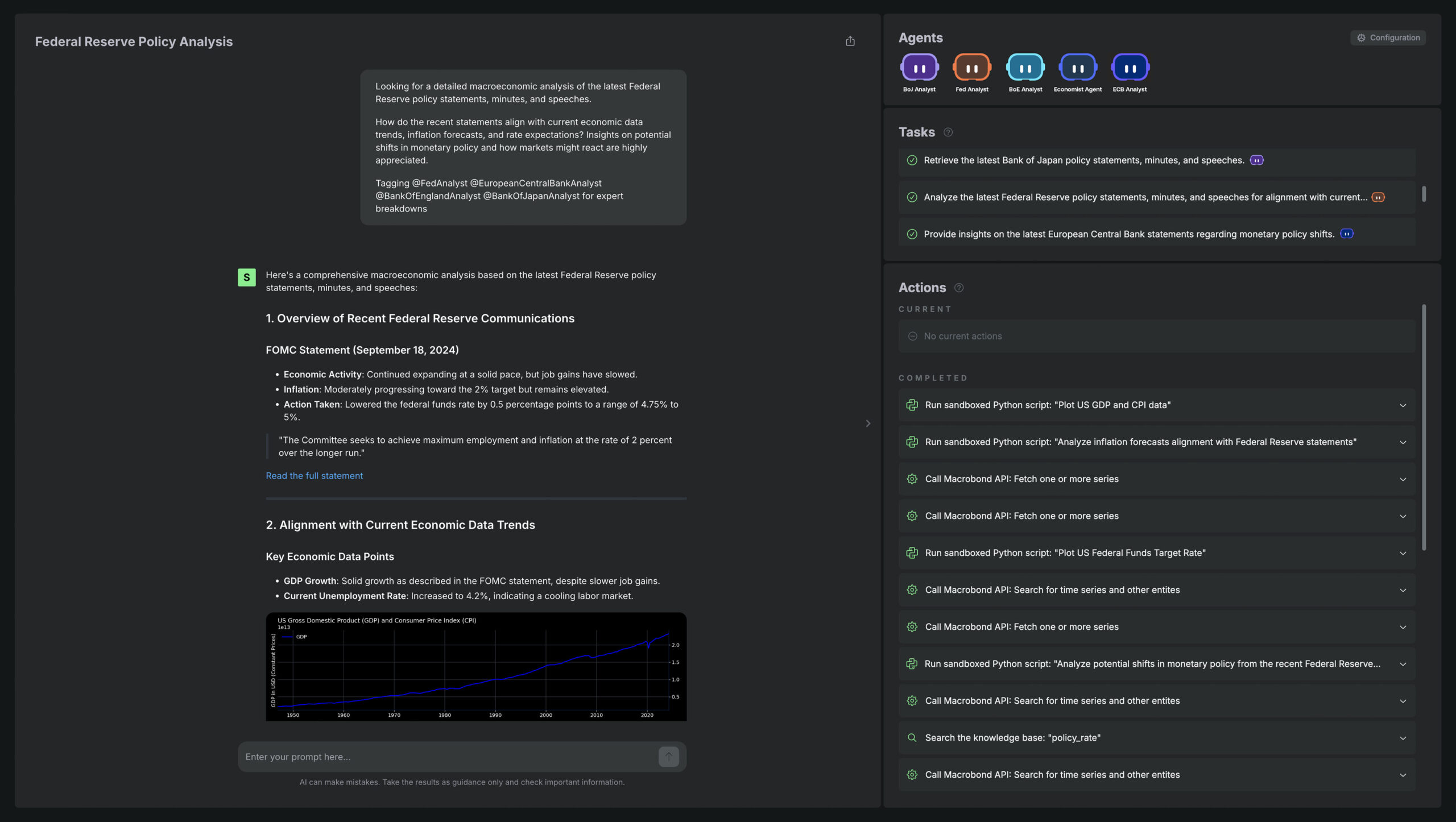

Analyze Monetary Policies by Central Banks

AI macro analysts dissect statements, minutes and speeches by the Federal Reserve, European Central Bank, Bank of England, Bank of Japan etc.

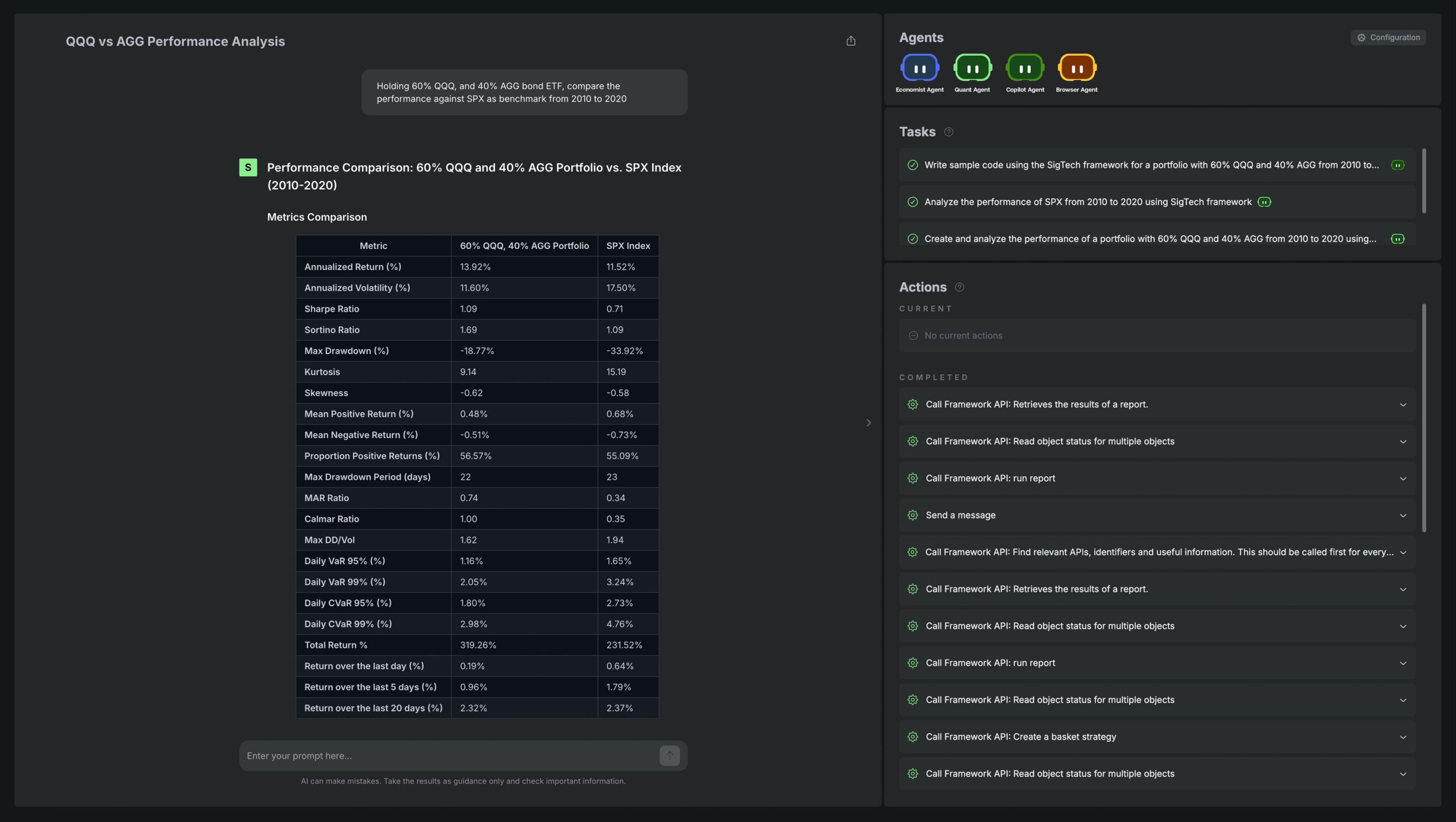

Build and Benchmark Investment Portfolios

AI quant analysts construct portfolios and calculate performance metrics.

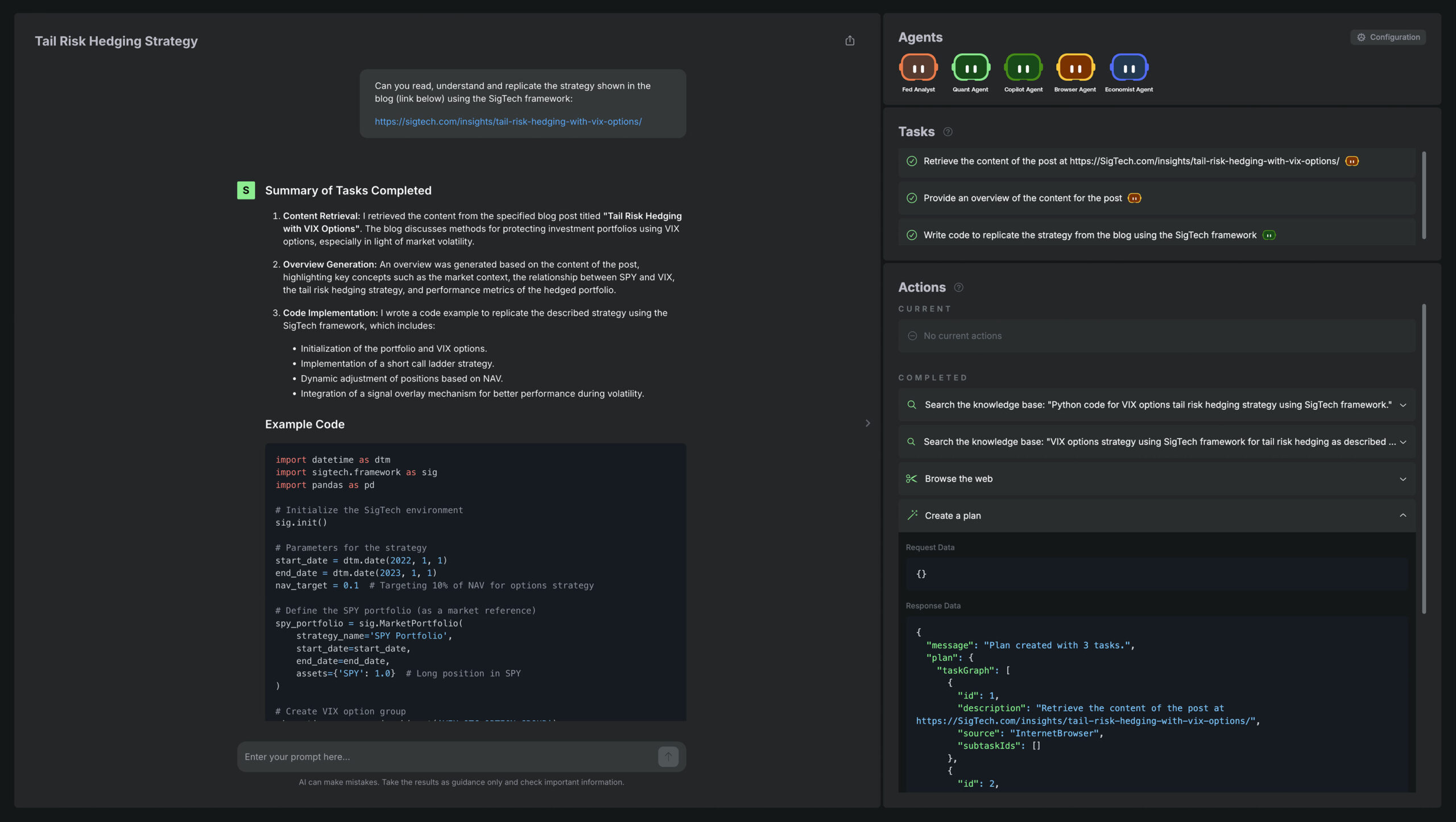

Code and Backtest Trading Strategies

AI quant analysts implement trade ideas in Python based on description.