A recording of the live session is now available for viewing.

The hedge fund industry is booming, with nearly 2,000 new launches every year since 20191. However, building the framework for a systematic fund is a complex task. It requires time, capital, and access to the technology solutions necessary to succeed.

SigTech recently hosted a webinar to discuss how emerging managers implement and launch a new systematic fund. The panelists Franz Valencia, Founder of Argmax Capital, and Thomas Orbert, CIO and Founder of TruePenny Capital Management, provided a US and European perspective on:

- Raising capital

- Demonstrating expertise

- Developing infrastructure

Below is a transcript of the key lessons from Franz and Thomas on how to successfully navigate a fund launch.

Demonstrating Expertise

The first step when launching a new fund is demonstrating your expertise to prospective investors. What should an emerging manager consider and how do you best convince investors to commit seed capital?

Franz Valencia (FV): “To demonstrate your edge, a strong track record is the gold standard as it reflects your past achievements. However, when talking with clients and prospects, it is vital to put this track record into broader perspective. Discuss the lessons that you’ve learnt along the way, the things that hurt your performance, exposure you had in your portfolio and the reasoning behind it, and how you would do things differently knowing what you know today.

It is essential for emerging managers to demonstrate a continuous learning path and a commitment to understanding both your successes and failures.”

Thomas Orbert (TO): “We’re relying on our own experiences from over 20 years of risk and quantitative portfolio management. When approaching prospects we focus on the track record of our current strategies, which we have been managing with our own money for about a year. In addition, to showcase our unique investment proposition we present a full range of customized backtests.”

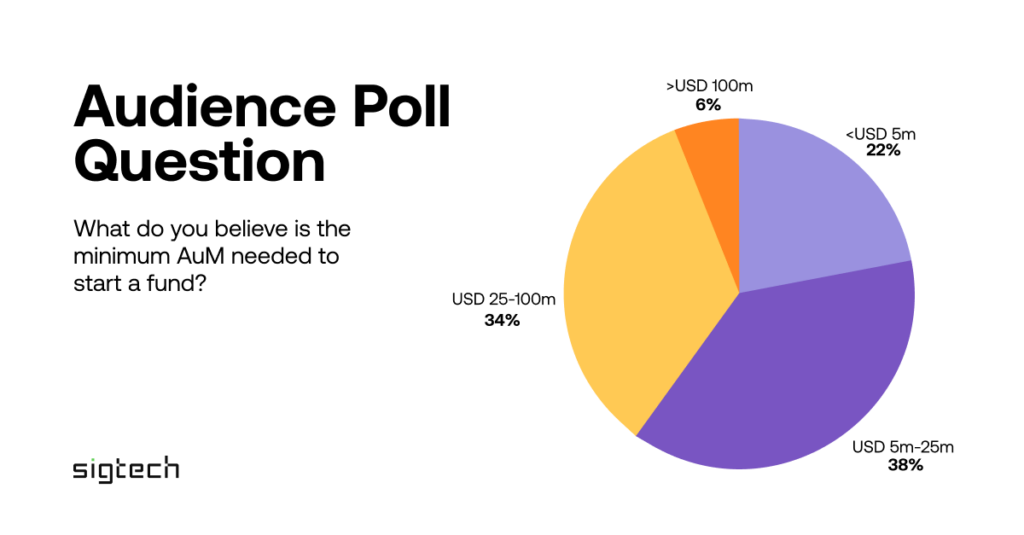

Minimum AuM for fund launch

Raising seed capital is an arduous process. What is the minimum capital you want to secure before you launch a fund? Is there a minimum level?

TO: “In general, I do not believe there is a minimum AuM level. In our case, to be operationally efficient, we need approximately USD 10-20m. However, we aim to start with ca. USD 50m, which would provide more operational flexibility and will be closer to our breakeven point in terms of cost structure.”

FV: “I agree with Thomas. In general, there is no minimum. However, if you are too small you can run into some issues, particularly on the execution side. We have defined our minimum of around USD 30m.”

Raising Capital

Where do you find seed money and how do you best raise capital after a fund launch? What investor groups are you focusing on at each stage?

FV: “Focus on your existing network at the seed stage. They know you best, are familiar with your investment strategy, and hopefully like you and your investment process. In terms of emerging manager distribution platforms, these can be used for educational purposes; determining industry players, and how the various distribution channels work.

Keep prospects in the conversation and abreast of what you’re doing in order to build long-term relationships. Due diligence is essential for understanding your target audience.”

TO: “The stage determines the sources we focus on. During the seed stage we rely on our existing network and institutional investors with a history of seeding emerging managers. After establishing a 2+ year track record we will broadly target institutional investors. When we reach an AuM of USD 300m we plan to utilize various cap intro services.”

Building Infrastructure

When building infrastructure to support your investment process, what are your top priorities? What is your view on building in-house vs. outsourcing?

FV: “When I started Argmax, my initial thought was, how do I want to spend my time? What is my edge? I built around that. I sought to focus on research and putting my ideas to work. In terms of infrastructure, the question is buy vs. build. We considered building but soon realized that it was not cost efficient and would take us too long to get up and running. We wanted to put our skills to the test as soon as possible. That meant outsourcing data management, backtesting, and production.”

TO: “Within the SigTech framework we have built the equivalent of an assembly line for research and deployment of systematic strategies. Apart from SigTech, we utilize Bloomberg as a portfolio management system. All other operational infrastructure is outsourced. We might eventually consider bringing it in-house. However, I honestly believe that these service providers are better shaped to do that than we are. We are better at creating and managing investment strategies and want to focus on that.”

Lessons from the Past

When starting your fund, what was the best thing you did?

FV: “One of the things that I am satisfied with is that we took our time; not rushing and not being afraid to change our perception of what constitutes an optimal modus operandi. In essence, stick to what you do best, and I think everything else will fall into place.”

Key considerations

The hedge fund industry is buoyant with a strong demand for systematic funds. To successfully launch a new systematic fund, our webinar panelists shared their experiences and highlighted:

- The importance of leveraging your track record and tapping into your existing network to secure seed money

- A focus on long-term relationship building with your target investor groups to attract capital after fund launch

- How the outsourcing of infrastructure significantly reduces time-to-market and lets you focus on your core competence of taking investment decisions

Ultimately, the launch of a systematic fund will be replete with difficulties. Focus on your core strengths and embrace flexibility by partnering with specialist service providers to help you prevail in a competitive marketplace.

Interested in launching a systematic fund of your own?

References

[1] Analysis shows hedge fund industry is booming

This document is not, and should not be construed as financial advice or an invitation to purchase financial products. It is provided for information purposes only and is subject to the terms and conditions of our disclaimer which can be accessed at: https://www.sigtech.com/legal/general-disclaimer