In our second in a series of three blog posts highlighting the key takeaways from the Trends in Institutional Investing: Allocation and Predictions for 2023 webinar, we focus on two topics: risk mitigating strategies and the next frontier in alternative investment strategies.

The blog shares insights from the discussion between Andreas Clenow, a seasoned quant and Chief Investment Officer at the Swiss-based family office Acies Asset Management, and Eric Battesh, VP of Alternative Investments at the US insurance company Selective.

Risk mitigating strategies

A central pillar in traditional portfolio diversification is that equities and bonds exhibit a negative correlation. In 2022, with both asset classes having posted double digit losses, institutional investors are facing a challenging year and are reassessing their existing asset allocation. Given that investors have a tendency to act pro-cyclically, especially during turbulent market phases, risk mitigating strategies are again a popular topic.

What is the best method or investment strategy to hedge your portfolio against larger portfolio losses? What is your view about tail risk strategies?

Andreas Clenow: ‘In general, I believe that bespoke tail risk strategies can make a lot of sense but we must recognize that there is a very wide range of strategies that fit under this umbrella. You need to define the strategy that fits your specific portfolio and investment mandate.

In my day-to-day operations running a family office I have a very long-term investment horizon and I apply an absolute return mindset to the portfolio allocation. This means that I have a slightly different perspective on tail risk strategies than many traditional institutional investors that are forced to think more short-term and thus might be more in need of portfolio protection strategies.

In terms of specific strategies, I want to highlight trend following, as a fairly simple and easy strategy to implement that gives you a kind of tail risk protection during times of distress.‘

Eric Battesh: ‘I’ve looked at various tail risk strategies, mostly to hedge equity risk and the major challenge I have identified is implementation. Tail risk strategies are great when you get the timing right, but that is an extremely difficult endeavor to undertake.

If you buy protection after a big market movement, it will be very expensive and will likely add limited value. With that being said, I think that tail risk strategies are something you need to keep on your books without trying to time when you should or should not keep the exposure. However, keeping a tail risk strategy long-term can quickly get very expensive.

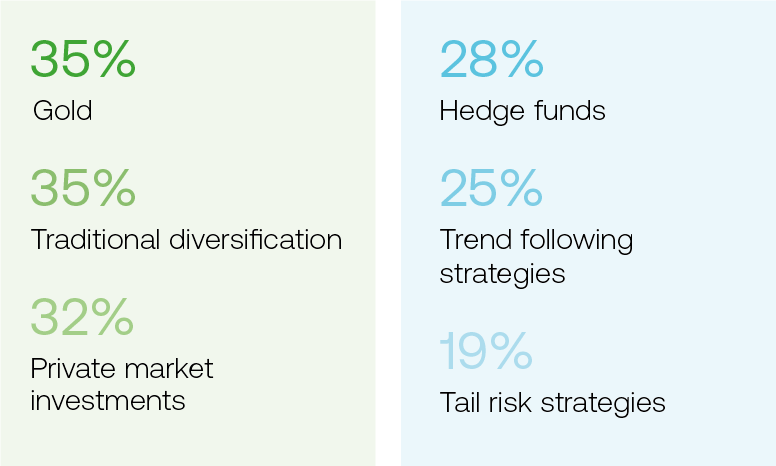

When implementing tail risk strategies, communication with your stakeholders is crucial; you need to educate them on why you do it and how you expect it to perform in different market environments. For example, if you implement an options-based strategy to hedge your equity exposure and the S&P 500 experiences a drawdown of 25%, it may not mean that the tail risk strategy made a lot of money. It depends on how the sell-off materialized. If there is a slow, linear sell-off, chances are that the strategy did not pay off much, whereas if there is a quick sell-off, such as in March 2020, the tail risk strategy would most likely have provided an excellent hedge.’ The SigTech Institutional Investor Report collated insights from 119 institutional investors globally that collectively oversee USD 2.1 trillion in assets under management. In regards to investment strategies and methods used to mitigate portfolio risk, traditional diversification across asset classes together with investment in physical gold are seen as the two most efficient approaches. Interestingly, only one in five mentioned tail risk strategies, which presumably is a function of their complexity and limited offering of readily investable products.

Next Frontier of Alternative Investment Strategies

The investment management industry has historically been very innovative when it comes to developing and promoting new products and investment ideas. In the field of alternative investments we have experienced a big rise in private market investments over the past 10-15 years. And in the more traditional space, the rise of index funds has been the most notable trend.

What’s next in terms of both new investment strategies and existing investment strategies that you believe will become mainstream over the next 5 to 10 years?

Eric Battesh: ‘First, I think retail investors will have more exposure to alternative investment strategies. There are already products out there that make it easier for them to invest in alternatives, with benefits over traditional PE, such as lower minimum commitment sizes, no capital calls to deal with, and simplified tax reporting. This will result in more inflows to private markets from retail investors.

Another trend I think will gain traction is the issuance of Collateralized Fund Obligations (CFOs). In the near term, I expect CFO issuance to grow due to pension funds looking to reduce risk in their portfolio. The pension fund community, as a group, is overweight private equity exposure and can use CFOs as an efficient way to actively manage their exposure. In the long-term, I expect CFOs will be a useful fund raising tool for asset managers and an effective way to diversify exposure for allocators.’

Andreas Clenow: ‘I also see the trend for more and more alternative investment strategies being offered to retail investors but I want to note that for certain strategies there is a reason why they are only approved for professional investors. Ultimately, the industry is innovative enough to eventually find ways to structure investments to be able to offer them more broadly.

The demand for more advanced quantitative strategies is rising and I expect to see more strategies making proper use of machine learning as a way to generate alpha. Furthermore, the political side of investing is becoming more important, in particular to the younger generation, and will lead to increased implementation of ESG and impact investing and a greater role for the alternative investment space.‘The next and final blog post summarizing the key takeaways from the Trends in Institutional Investing: Allocation and Predictions for 2023 webinar will focus on how the two major trends of quantification and internalization are reshaping institutional investors’ investment process.

Disclaimer

This content is not, and should not be construed as financial advice or an invitation to purchase financial products. It is provided for information purposes only and is subject to the terms and conditions of our disclaimer which can be accessed here.