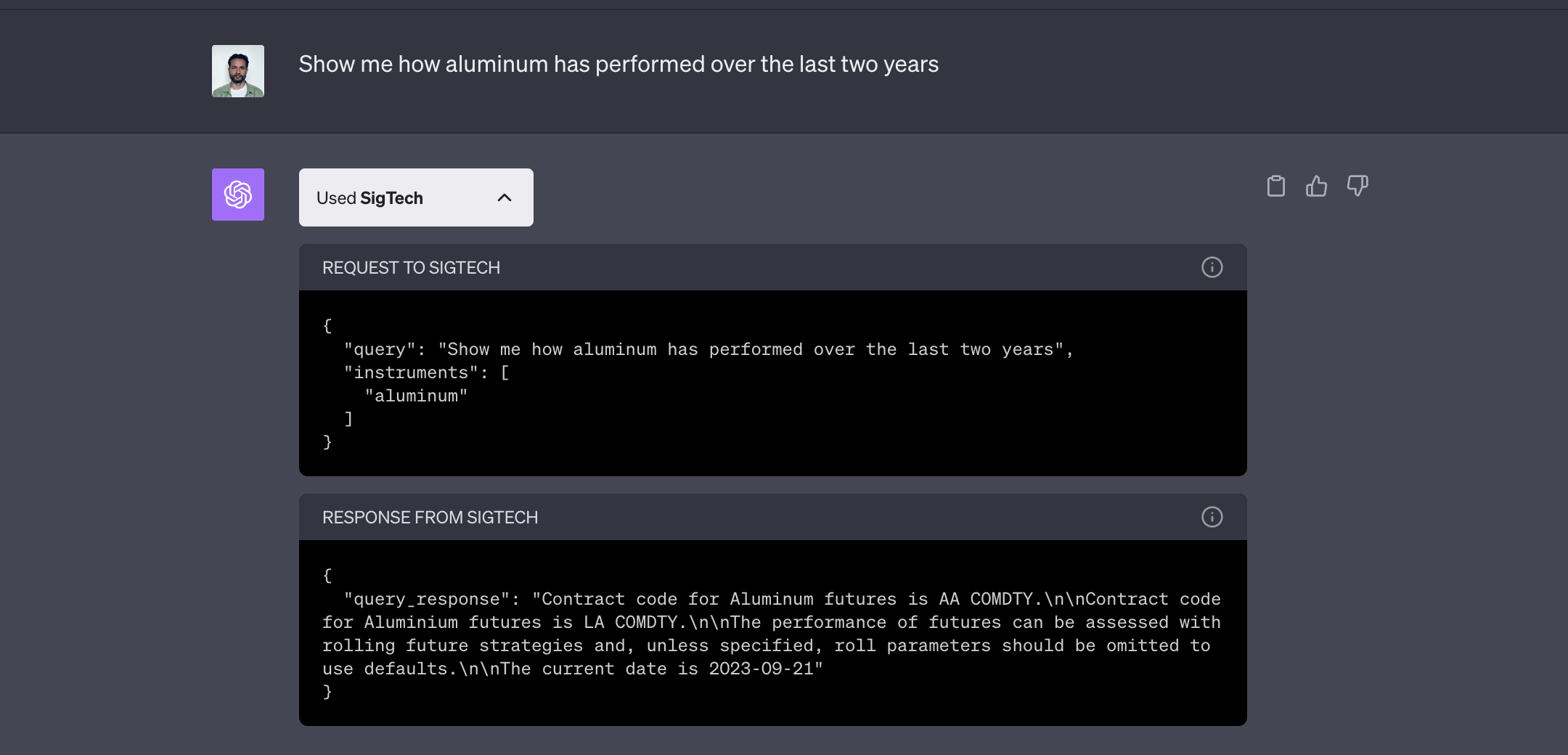

Examine anything you can trade

Get reliable market data from premium providers, cleaned and validated by SigTech.

Example prompt

View chatCompare the Vanguard FTSE Developed Markets ETF and the Vanguard FTSE Emerging Markets ETF over the last 10 years

Test a portfolio in seconds

SigTech’s clients demand the utmost reliability in trade simulation when evaluating their strategies against historical data. Now you can access this technology in simple chats.

Example prompt

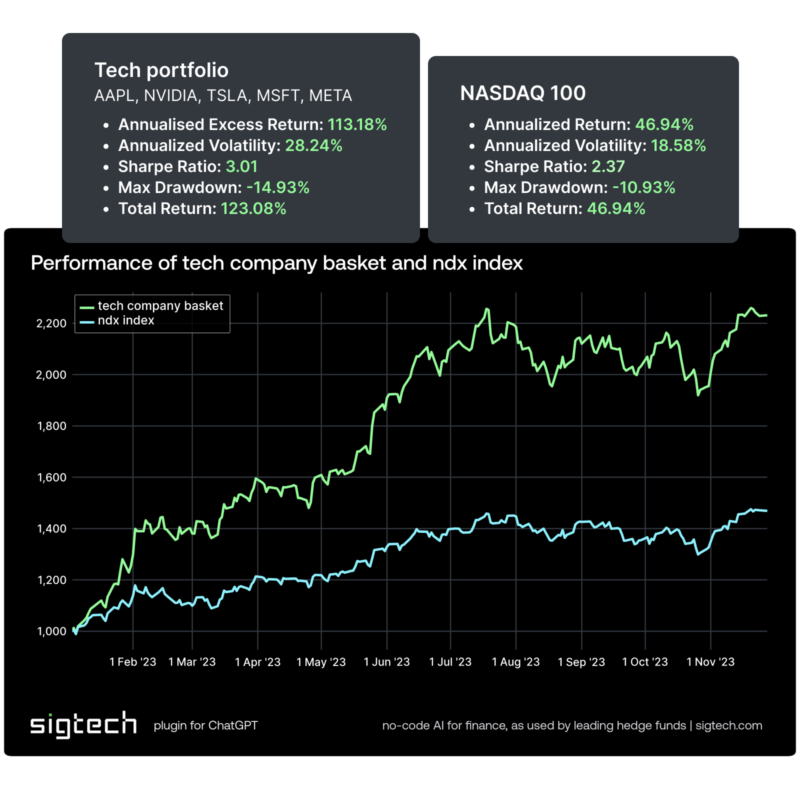

View chatHow would a portfolio consisting of Apple, Meta, NVIDIA, Tesla, and Microsoft have performed in comparison to the NASDAQ 100 INDEX in 2023?

Example prompt

View chatAnalyze the 10 year performance of a portfolio with a 70% long position in Apple (AAPL) and a 30% short position in the NASDAQ 100 index

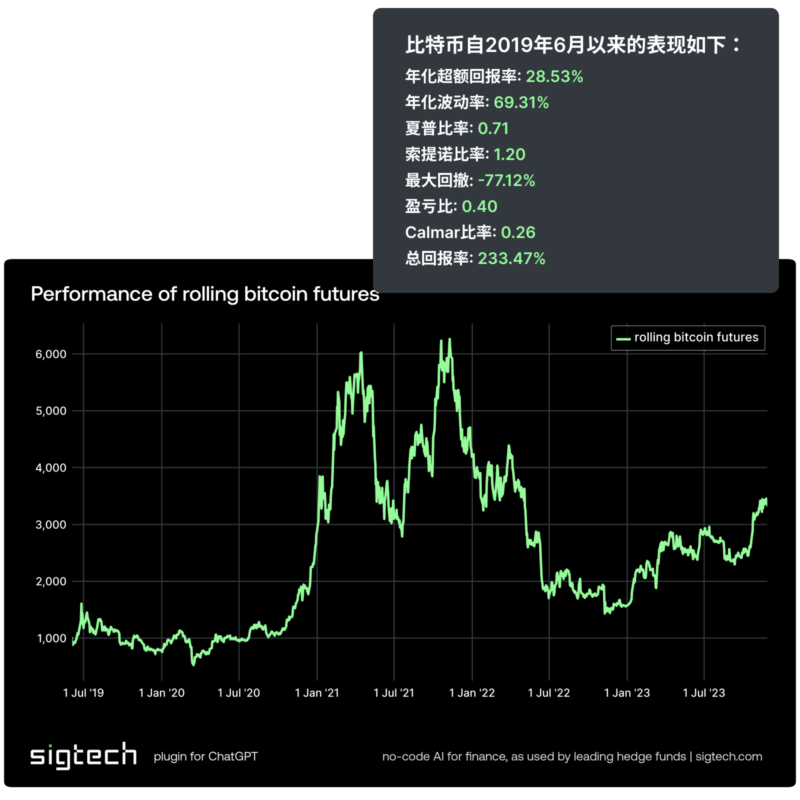

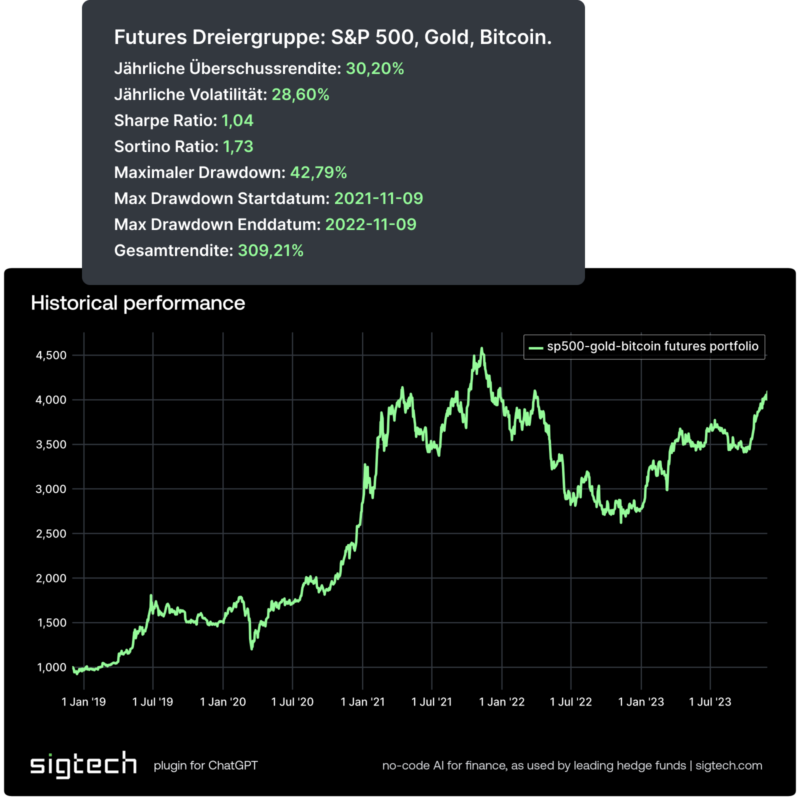

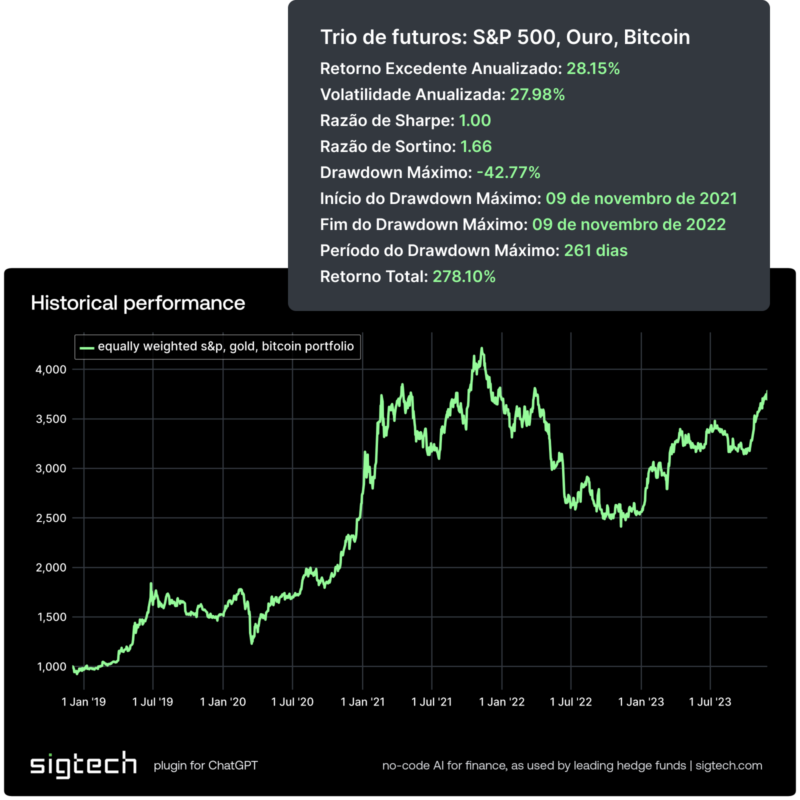

Speak your language

Don’t let language barriers slow you down. SigTech AI powered by ChatGPT-4 works in any tongue.

Example prompt

View chat¿Cual hubiera sido el rendimiento de una cartera ponderada equitativamente de futuros del S&P 500, del oro y del Bitcoin, rebalanceada trimestralmente, en los últimos 5 años?

Example prompt

View chatكيف كان أداء محفظة مستقبلية متوازنة بالتساوي من S&P 500 والذهب وبيتكوين، مع إعادة التوازن كل ربع سنة، خلال الخمس سنوات الماضية؟

Example prompt

View chatКак бы портфель будущих контрактов, равномерно распределенный между S&P 500, золотом и Bitcoin и перебалансированный каждый квартал, показал себя за последние 5 лет?

Example prompt

View chatWie hätte sich ein quartalsweise neu ausbalanciertes, gleichgewichtetes Futures-Portfolio aus S&P 500, Gold und Bitcoin in den letzten 5 Jahren entwickelt?

Example prompt

View chatComo teria se saído uma carteira de futuros igualmente ponderada de S&P 500, ouro e Bitcoin, reequilibrada trimestralmente, nos últimos 5 anos?

The choice of leading hedge funds

Our custom version of ChatGPT uses the same hyper-realistic trade modeling trusted by the world’s leading investment funds for over a decade. Check out the SigTech platform to find out more about SigTech’s unique technology.

Unparalleled access to multi-asset data

Futures (including equity indices, commodities, FX, bonds, interest rates, volatility indices, Bitcoin and Ethereum)

Single stocks

Equity indices

ETFs

FX spots

Macroeconomic indicators

Data you can rely on

SigTech collaborates with top data providers, rigorously scrutinizing the data for accuracy before incorporating it into our financial models.

FAQ

-

What skills do I need?

Just an interest in finance! You don’t need to know any code, math, modeling, etc. Put your feet up and let the AI do the work.

-

How accurate is it? Doesn’t ChatGPT make errors?

All data provided by SigTech to ChatGPT comes from the same database of clean, premium financial data and hyper-realistic financial models that we offer to our platform clients. Accuracy and precision are our bread and butter, which is why institutional investors managing a collective $5 trillion use the SigTech platform.

That’s why SigTech’s integration is a game-changer for those using ChatGPT for serious financial analysis. While ChatGPT excels in verbal reasoning, it can be less reliable with math and has no access to historical financial data. The SigTech integration provides ChatGPT with the empirical data, math, and models it needs to complete its skill set.

-

Where is the data coming from?

SigTech has relationships with multiple premium data providers. All the data is meticulously cleaned, harmonized, pre-mapped, and validated by SigTech, and the data is fed to ChatGPT via the SigTech API.

The data sources currently used for the API are:

- CSI, for equity indices, ETFs and futures (including commodities, equity indices, FX, bonds, interest rates, volatility, Bitcoin, and Ethereum)

- EDI, for FX.

- Quandl, for single stocks.

- FRED, for macroeconomic indicators.

- Copp Clark, for the market holiday and trading information used in SigTech’s trading simulations.

-

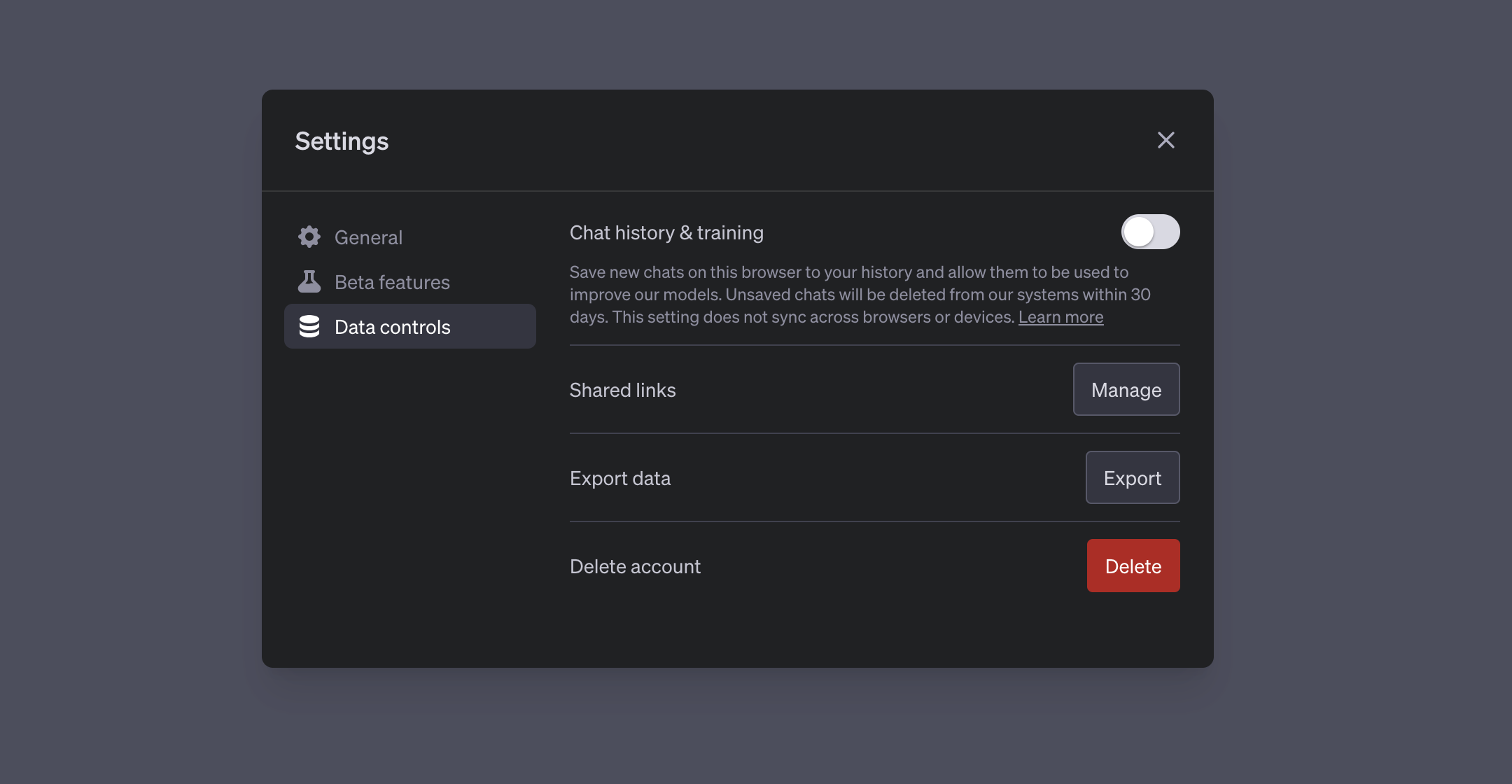

Are my conversations private?

By default, OpenAI (the creators of ChatGPT) can access all your conversations. However, you can change this in your ChatGPT settings. Just go to “Data Controls” and turn off “Chat History & Training.”

SigTech can only see your interactions with the SigTech API, nothing more. To view the specific data shared with the SigTech API, see the “request to SigTech” boxes in your conversations. We use this information to improve your experience. Rest assured, SigTech will never share any of this with third parties.

-

Do I need a ChatGPT Plus account?

Yes. Currently OpenAI only allows ChatGPT Plus users to access plugins and custom GPTs.

To get a ChatGPT Plus account:

- Sign up for a ChatGPT account (or log in to your existing account).

- In the ChatGPT interface, go to “My plan”.

- Upgrade to a Plus account.

-

What are the terms of use?

All SigTech’s integrations with ChatGPT use the SigTech API. The same terms of use apply: API terms of service

Have another question? Talk to us:

/ Twitter

Finance, meet AI

We’ve given ChatGPT premium financial data and state-of-the-art portfolio construction. What do you want to ask it?