In the decade following the 2008 Global Financial Crisis (GFC), investors profited from a period when more or less all asset classes posted strong gains. However, this vigor abruptly ended in 2022, with financial markets experiencing substantial losses.

To gain an understanding of institutional investors’ current market outlook and the implications for their portfolios, SigTech hosted the Trends in Institutional Investing: Allocation and Predictions for 2023 webinar. Daniel Leveau, VP Investor Solutions at SigTech, hosted a panel discussion with Andreas Clenow, CIO of Acies Asset Management, and Eric Battesh, VP of Alternative Investments at US insurance company Selective.

This blog post, the first in a series of three highlighting the key takeaways from the discussion, focuses on the topics of risk and allocation.

Risk outlook

The ‘goldilocks’ economy that prevailed for most of the 2010-2019 period was characterized by historically low volatility levels in the financial markets. However, with inflation spiking, interest rates rising and geopolitical tension heightening, risk has again emerged as a central consideration for investors.

What are the key risks to watch over the next few years and why?

Eric Battesh: I believe the primary risk we face is inflation being ‘sticky’ and not coming down to the 2-3% range the Fed wants and investors expect. Higher rates will have continued adverse implications for housing affordability, corporate earnings, and cap rates in the commercial real estate sector, to name a few.’

Andreas Clenow: ‘I agree with Eric that inflation is a key risk but would also add the current geopolitical situation. In particular, the war in Ukraine is heavily impacting the global energy supply chain. This, for instance, results in Europe needing to define what a new energy policy – that is not dependent on Russian oil and gas – shall look like over the coming 10-20 years.

In the shorter term, I am closely monitoring the potential spillover effects on traditional asset classes from the meltdown in the digital asset space. It will be interesting to see how closed an ecosystem crypto is and if any larger systemic risks will materialize.

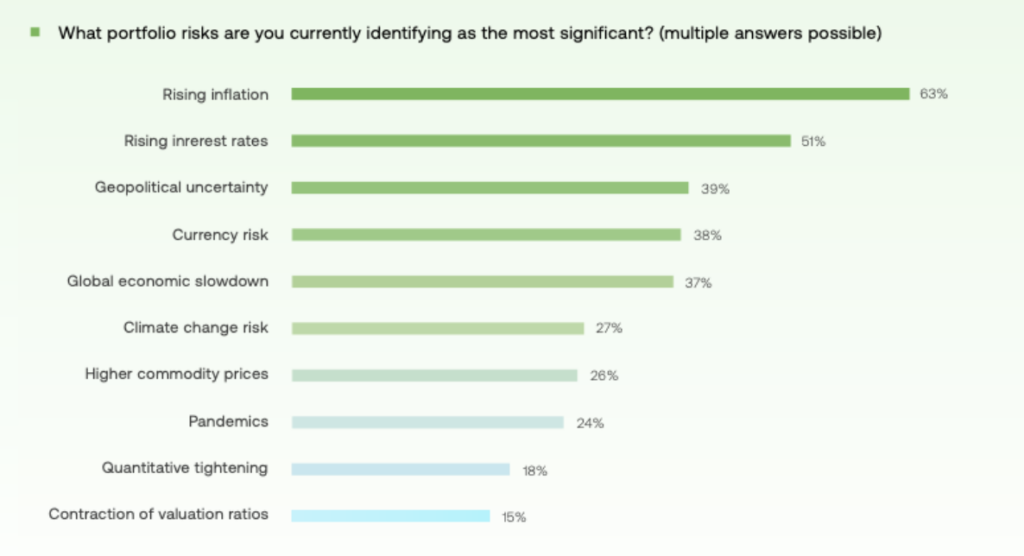

In December 2022, SigTech published its annual SigTech Institutional Investor Report that is based on input from 119 leading institutional investors globally that collectively oversee USD 2.1 trillion. The study shows that inflation is identified by 63% of the respondents as the primary risk to watch. The second biggest risk is rising interest rates; mentioned by half of the respondents. This was followed by geopolitical uncertainty, currency risk and a global economic slowdown. Noteworthy is that only 24% cited the pandemic and 27% climate change as key portfolio risks.

Asset allocation

The strong performance of most major asset classes over the past decade helped institutional investors post stellar returns and quickly recover from the large drawdowns sustained during the GFC of 2008-09. In 2022, the negative correlation between equities and bonds collapsed, with both markets entering bear market territory. This change has forced institutional investors to reassess their existing asset allocations in order to meet future return targets.

Given the risks you just mentioned, what changes have you made or do you expect to make to your portfolios? Furthermore, what trends do you see among other institutional investors?

Eric Battesh: ‘In the insurance industry, most assets are in investment grade fixed income. Compared to 2020 for instance, when the industry was reinvesting capital at historically low yields, the situation has definitely improved this year. In this environment, a company can increase the quality of the bonds they buy and invest at a significantly higher yield.

To gain an understanding of why this is so important, assume the property & casualty insurance industry has investment leverage of approximately 2.5x. If investment grade bond yields are at 5%, the ROE contribution from investment grade bonds is 12-13%. So, it is actually a great environment today for the industry to put money to work and buy high-quality fixed income at attractive yield levels.

However, there is of course a flip side to higher interest rates. Higher rates normally have an adverse impact on real estate prices. With banks tightening lending standards and commercial real estate valuations declining, an owner could be forced to add additional equity when their debt comes due. This creates preferred equity opportunities for long-term investors.’

Andreas Clenow: ‘It is indeed a time of big changes in the financial markets. This is actually quite nice as it creates a lot of interesting opportunities to capture.

As a family office we have a large degree of freedom on how to allocate our assets. We have a sizable strategic allocation to the absolute return space. Given my background as a quant, I have a strong understanding of – and affinity for! – systematic investment strategies. Within the current market environment, I believe that the managed futures space with, for instance trend following strategies, to be interesting as such strategies have historically proven to perform well in turbulent market phases.

I also want to mention that the normalization of the risk free rate will surely be a positive for the hedge fund industry as a whole and that I expect the energy sub-sector to offer interesting opportunities.’

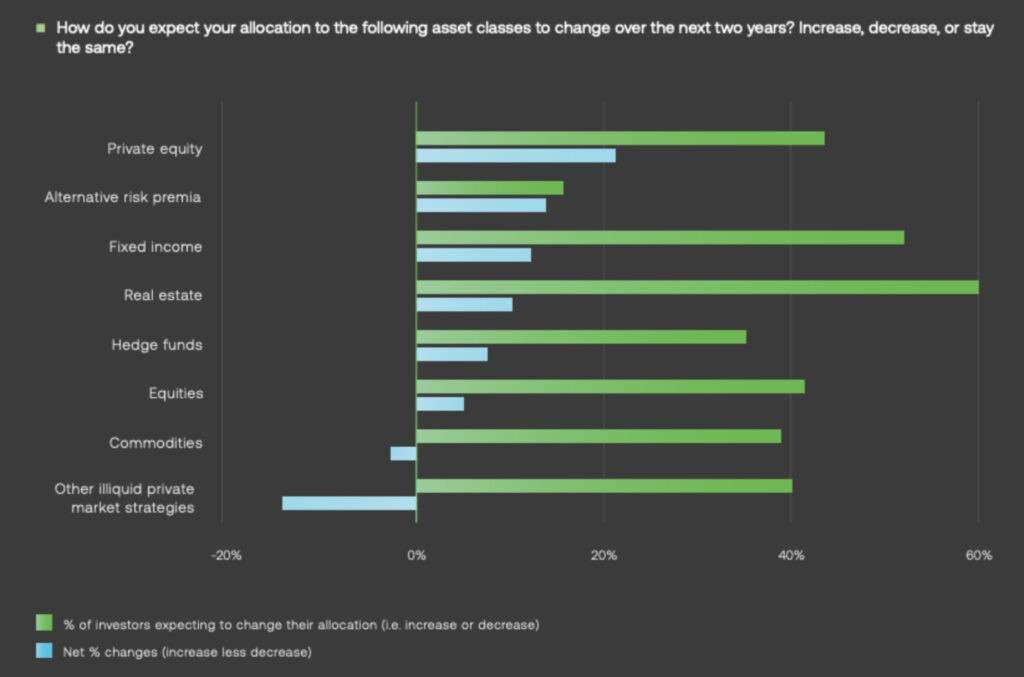

According to the SigTech Institutional Investor Report, investors expect the largest changes to their existing allocations (i.e. absolute sum of increases and decreases) to be in the real estate and fixed income asset classes, with more than half of investors expecting a change. However, for most other asset classes, disagreement over the direction of allocations is commonplace. On a net basis (i.e. increases less decreases) private equity (21%), alternative risk premia (13%) and fixed income (12%) are expected to see the largest increases in allocations.

The next and final blog post summarizing the key takeaways from the Trends in Institutional Investing: Allocation and Predictions for 2023 webinar will focus on how the two major trends of quantification and internalization are reshaping institutional investors’ investment process.

Disclaimer

This content is not, and should not be construed as financial advice or an invitation to purchase financial products. It is provided for information purposes only and is subject to the terms and conditions of our disclaimer which can be accessed here.