67% of all hedge funds globally and 70% of all new fund launches are US-based

Crypto hedge funds appear for the first time in the top 10 of hedge fund strategies

- 22% of hedge funds apply a purely quantitative investment process and ca. 2% use artificial intelligence

Our in-depth analysis[1] reports that after continued expansion in 2021, there are currently 27,255 active hedge funds globally.

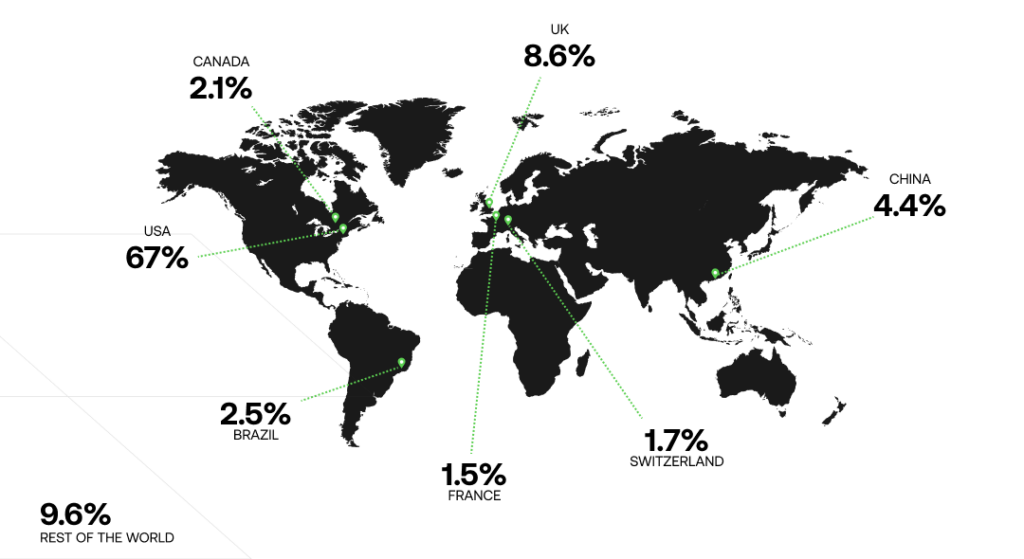

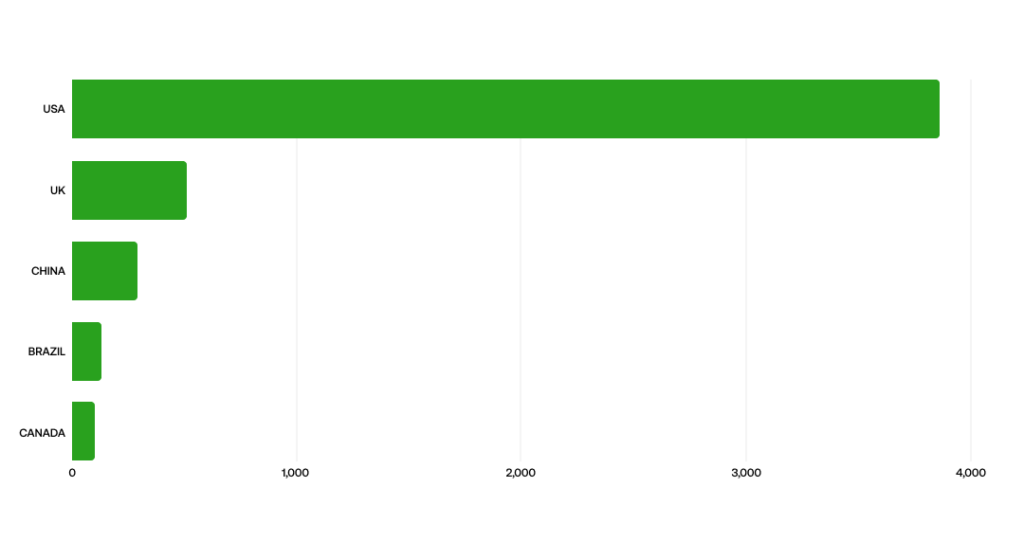

Geographical breakdown

The hedge fund industry remains dominated by the US market, which is home to 67% of all hedge funds globally, followed by 9% in the UK, 4% in China, and ca. 2% each in Brazil, Canada and Switzerland.

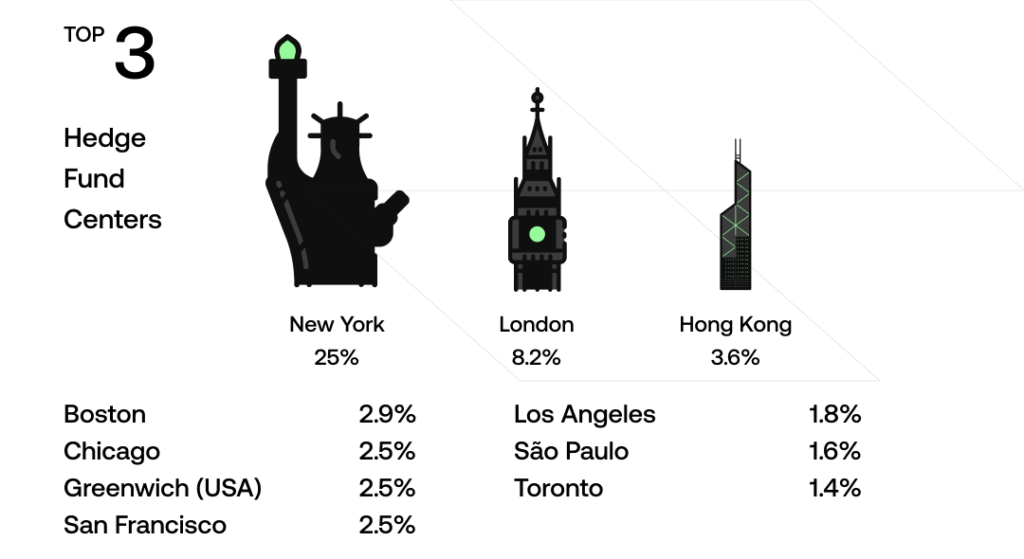

When it comes to the cities that have the largest concentration of hedge funds, unsurprisingly New York is the clear leader with nearly 7,000 funds (25.0% of total), followed by London with over 2,000 (8.2%), and Hong Kong with nearly 1,000 (3.6%).

Daniel Leveau, VP Investor Solutions at SigTech, comments: “Our analysis reveals a strong and vibrant global hedge fund industry. Despite a healthy growth in emerging hedge fund centers, US-based managers continued to dominate the industry, both in absolute numbers and in terms of new fund launches.

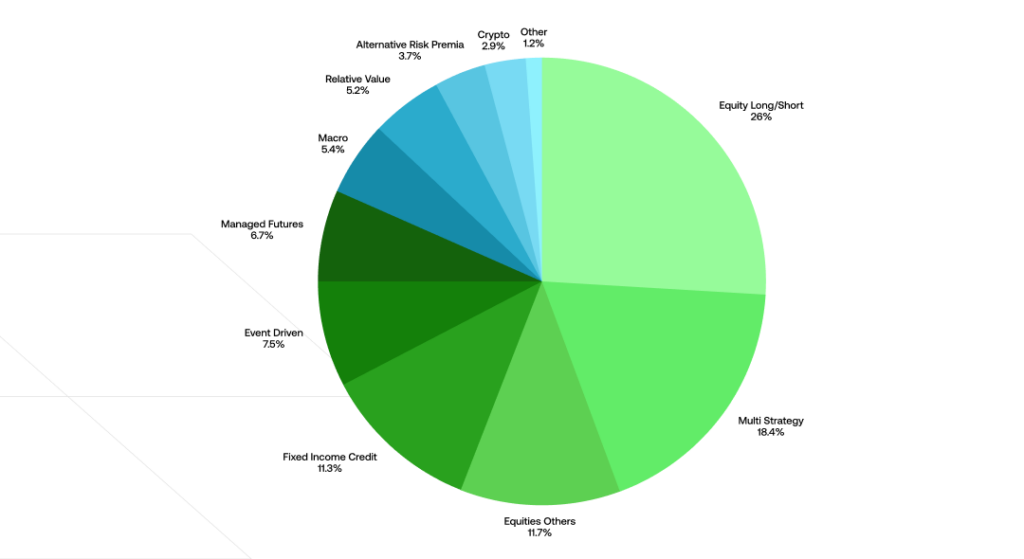

Strategy breakdown

The most popular hedge fund strategy is Equity Long/Short, followed by Multi Strategy, Equities others (e.g., long bias, short bias), Fixed Income Credit and Event Driven. The fast-growing sub-strategy Crypto now makes up ca. 3% of all hedge funds. Also noteworthy is that 22% of the world’s hedge funds apply a purely quantitative investment process and ca. 2% claim to use artificial intelligence.

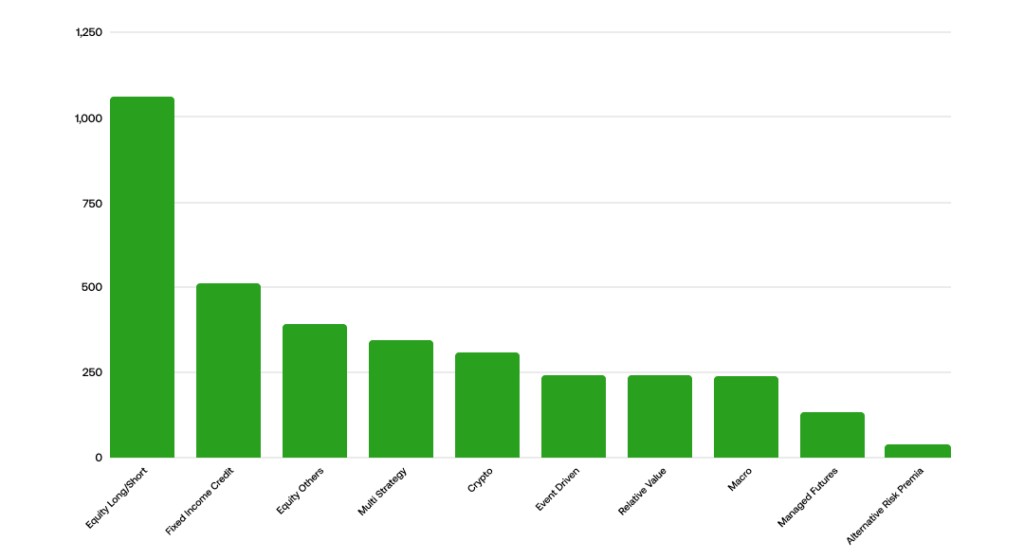

New hedge fund launches

On the backdrop of a strong performing hedge fund sector, new fund launches remain strong, with nearly 2,000 new launches per year on average since 2019. Of the 5,500 new hedge funds launched since 2019, 70.2% are based in the US, 9.3% in the UK and 5.2% in China.

The most popular strategy for these new funds is Equity Long/Short, followed by Fixed Income Credit, Equity others (e.g. long bias, short bias) and Multi Strategy.

Leveau adds: “The robust level of new hedge fund launches reflects a sustained strong demand from investors for innovative and uncorrelated investment strategies to meet return expectations in an increasingly challenging market environment. Hedge fund growth shows no signs of abating, fueled by the ever-increasing investment opportunities in the market, and the growth of new data and tools available to these funds.”

Crypto hedge funds on the rise

In 2021, a record number of 171 crypto hedge funds were launched. In total, there are now 774 hedge funds focused on crypto, with the US again being the driver of innovation with 80% of these funds domiciled in the US.

We are investing heavily in our quant technology platform to satisfy the strong demand from hedge funds looking to accelerate their data-driven investment processes. Alongside the growing hedge-fund community, SigTech enjoyed strong growth in 2021. Clients with a combined AUM of over $5 trillion are now using our platform, including some of the world’s leading hedge funds, as well as recently launched start-up systematic funds.

Daniel Leveau

[1] Study based on market intelligence from SigTech’s hedge fund clients and data from Preqin (as of February 2022)

Disclaimer

This content is not, and should not be construed as financial advice or an invitation to purchase financial products. It is provided for information purposes only and is subject to the terms and conditions of our disclaimer which can be accessed here.