2022 witnessed the return of inflation and an increase in bond yields across the curve. This coincided with a correction in global equities, with the S&P 500 falling 17.9% across the year. Thus, the economic landscape we face in 2023 is one characterized by concern over volatility. As a consequence, asset owners require the tools and investment strategies necessary to diversify their portfolios to protect against highly volatile markets producing larger drawdowns. Investment managers may instead seek to exploit the opportunities for alpha generation heralded by increased volatility. Both of these endeavors require access to high quality options data and a research environment which facilitates the efficient construction and scaling of bespoke investment strategies.

The SPDR S&P 500 ETF (SPY) is the oldest and largest exchange-traded fund (ETF). The CBOE VIX is a 30-day benchmark tracking expected future volatility in the S&P 500. Generally, the SPY and VIX are negatively correlated. This blog explores how VIX options can be used to hedge an investment in the S&P 500 against tail risks.

Tail Risk Strategy Using a VIX Short Call Ladder

This investment strategy constructs a portfolio of SPY and then uses a short call ladder on VIX options to hedge against larger drawdowns. The ladder is constructed shorting an at-the-money (ATM) VIX option and buying two far out-the-money (OTM) VIX options. The option strategy is expected to protect against large swings in volatility – a market environment in which it is expected to generate high returns – as well as making money when volatility remains largely static.

We begin by building our short call ladder using the following basket of VIX options.

| Option | Option Type | Maturity | Strike | Position |

|---|---|---|---|---|

| 1 | Call | 1 Week | Spot | Short |

| 2 | Call | 1 Week | Spot +25% | Long |

| 3 | Call | 1 Week | Spot +50% | Long |

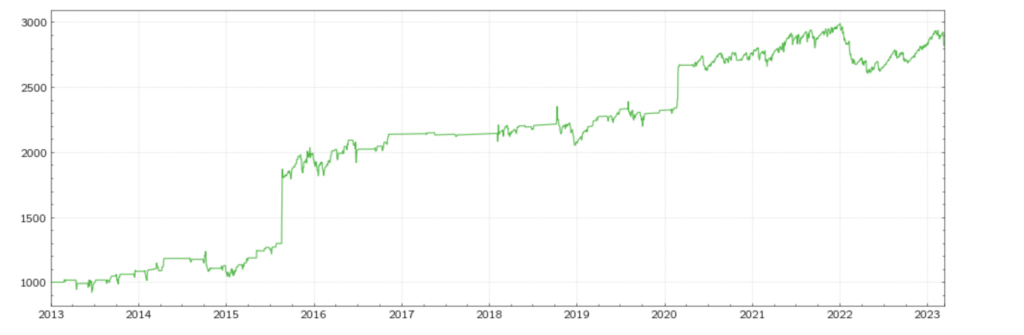

Using SigTech’s Dynamic Options Strategy building block, these options are combined into a single strategy, rolled weekly, with our position scaling to 10% of the strategy’s net asset value (NAV)1. At each roll, we sell an ATM call option and use the premium to purchase two far OTM call options. Our initial trade sells $100 worth of our ATM call option and buys $10 worth of our first OTM call and $2 of our second OTM call. Due to scaling, our final trade sells $300 worth of the ATM call and buys $30 and $6 worth of our respective OTM calls. Transaction costs are also simulated. A backtest returns the following performance for the January 2010 and March 2023 time period.

Dynamic Options Strategy | VIX Short Call Ladder

Source: SigTech, simulated performance in USD

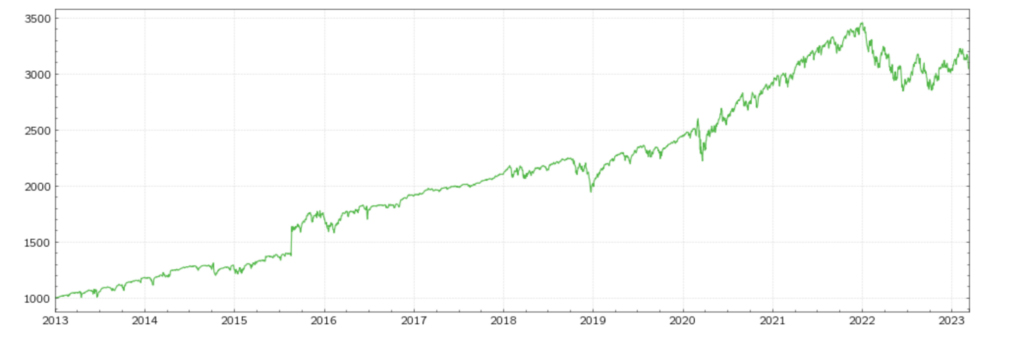

Signal Overlay

Using the Signal Strategy building block, we construct a signal overlay for our short call ladder. This closes out our options trades in the event that the VIX increases drastically, allowing us to realize our profits. The parameters which determine when to close out a trade are fully customizable on the SigTech platform.

Signal Overlay on a VIX Short Call Ladder

Source: SigTech, simulated performance in USD

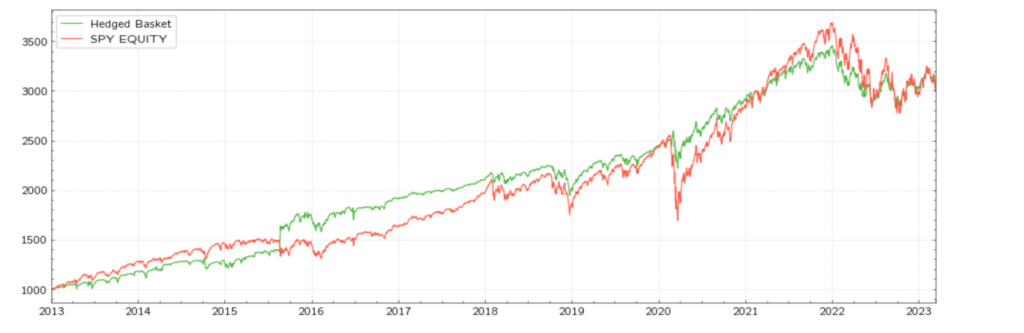

Hedged Basket: SPY US Equity ETF and VIX Short Call Ladder

To build the strategy which our options ladder will hedge, we utilize SigTech’s pre-built and fully customizable SPY US Equity ETF reinvestment strategy object. This can be called with a single line of code.

Our SPY reinvestment strategy and options call ladder are combined into an equally-weighted (50/50) portfolio using the Basket Strategy building block.

Hedged Strategy | SPY US Equity ETF & VIX Short Call Ladder

Source: SigTech, simulated performance in USD

The performance of the hedged strategy in relation to the reinvestment strategy in isolation is described in the following plot.

Hedged Basket vs. SPY US Equity ETF

Source: SigTech, simulated performance in USD

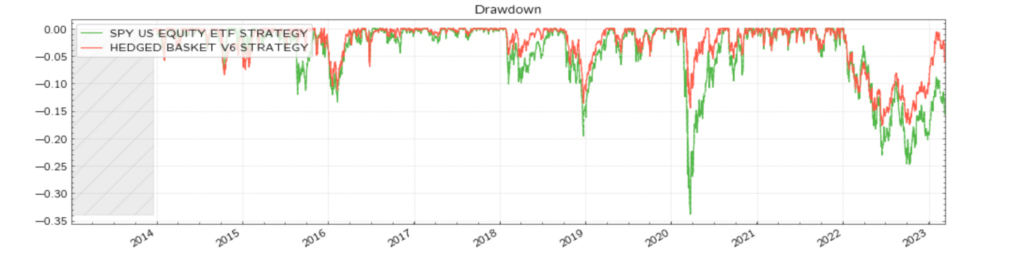

A set of key performance and risk metrics can be tabulated using SigTech’s performance report functionality.

| Strategy | Return, p.a | Volatility | Sharpe Ratio | Maximum Drawdown | Mean Negative Return |

|---|---|---|---|---|---|

| SPY Reinvestment Strategy | 11.42% | 17.37% | 0.711 | – 33.81% | – 0.73% |

| Hedged Basket | 11.51% | 12.35% | 0.915 | – 17.65% | – 0.50% |

Source: SigTech, simulated risk/-return data (in USD) for Jan 2010 – Mar 2023

The impact from the hedging is evident in a comparison of the two drawdown plots. When the S&P 500 falls sharply, the negatively correlated VIX rises. In turn, our far OTM calls net a profit, which can be seen in the comparatively lower drawdown of our hedged basket strategy.

Drawdowns | Hedged Basket vs. SPY US Equity ETF

Source: SigTech, simulated performance in USD

Bespoke Tail Risk Strategies

This blog has demonstrated how the use of VIX options data can provide an effective hedge for a buy-and-hold investment in the S&P 500. After the market turbulence of 2022, investors may seek greater protection from high volatility than that afforded by simple cross-asset diversification. Yet, sharp drawdowns as a consequence of unexpected market events do occur. Tail risks call for the application of bespoke strategies specifically tailored to investor needs. Our hedged basket with VIX options data offers a single example of the functionality and data available on the SigTech platform.

Disclaimer

This content is not, and should not be construed as financial advice or an invitation to purchase financial products. It is provided for information purposes only and is subject to the terms and conditions of our disclaimer which can be accessed here.

1 The Dynamic Options Strategy building block allows users to create a strategy trading a customized basket of options drawn from the same options group. A strategy trading options drawn from more than one options group can be constructed using our Dynamic Multi Options Strategy building block.