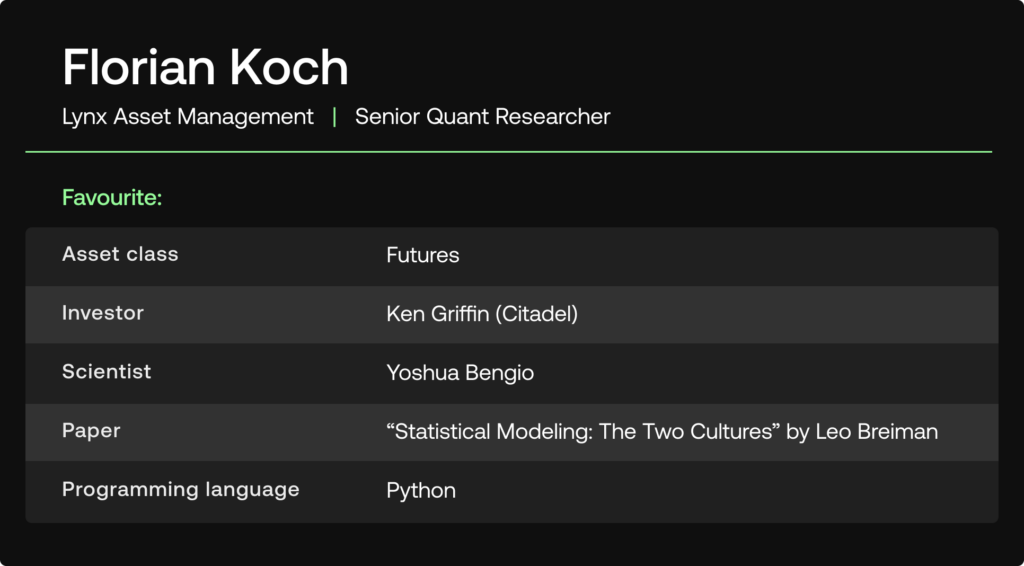

In this edition of SigView – a Quant’s Perspective, we have the privilege of gaining insights from senior quant researcher Florian Koch. Florian works at the Swedish-based hedge fund Lynx Asset Management and is an expert in the fields of alternative data and machine learning. Lynx is one of Europe’s most successful investment firms and is best known for its flagship strategy the Lynx Programme, which manages assets of ca. $8.5bn, making it one of the world’s largest CTAs.

We hope you enjoy the conversation.

Florian, tell us about your role at Lynx Asset Management.

I am a senior researcher in the model development team of Lynx Asset Management. That is the team responsible for developing new systematic trading strategies and maintaining existing ones. Lynx has been managing client capital for over 22 years and has a large book of existing models. Therefore, new models are not evaluated in isolation but in the context of how they add value to our portfolio. When I conduct my research, I try to innovate in two directions: using alternative data sources and finding new ways to apply machine learning techniques. My other responsibility is to scout for alternative data, not just for my own models, but for use by the rest of the company.

Our research team currently employs more than 30 researchers with varying technical backgrounds. Research is performed in groups using a collaborative approach and adhering to scientific methods.

What kind of investment strategies does Lynx Asset Management manage? What markets do you focus on?

Since our inception in 1999, Lynx has applied scientific methods to develop and implement proprietary systematic trading strategies based on a broad set of trading concepts. These strategies actively invest in global equities, fixed income, commodities and currencies.

What is unique about your quant models and investment strategies?

The way markets function changes over time and, consequently, one needs to adapt and innovate in order to thrive. For example, while our flagship strategy – the Lynx Program – is categorized as trend-following, we have introduced advanced statistical techniques and unconventional concepts over the years to maximize the value of the program to our investors.

Our team of researchers continuously reevaluate models in production and develop new models to improve the risk adjusted return potential of our programs. Researchers work in teams to develop and systematize the concepts underlying these models, after which their conclusions are questioned and critiqued by an internal designated peer group. Only after a model has been rigorously tested and analyzed is it considered for approval by our investment committee. We also take pride in our proprietary operational infrastructure and automated execution platform that has been designed to maximize security, robustness and flexibility.

What are the key challenges you face in your day-to-day operations as a quant researcher?

As a quant researcher, you have to be cognizant of potential biases in the conclusions you draw. Overfitting to the data is a well-known problem in quantitative finance and a lot of ink has been spilled discussing how to minimize it. We have implemented relatively sophisticated techniques to account for overfitting, which are particularly useful when developing complex statistical models, such as machine learning. However, working with new datasets introduces a selection bias that is difficult to control for.

We know that 90% of published academic articles find support for the hypothesis tested, and that there are 400 factors in top journals that are supposed to beat the market. Why? There are clear incentives to produce positive results as they generate more citations and hence a better academic career for the author. Similarly, we must assume that every data vendor has some “evidence” for the predictive power of their datasets. This is obviously a great challenge to handle as there are many that have clearly been fooled by randomness. We are extremely selective when deciding which datasets to employ, spending significant resources conducting due diligence on the provider and attempting to validate their results.

What is next on your research agenda? Both in terms of new investment strategies and quant models, as well as new technologies?

With a relatively large research team, we are conducting research across a spectrum of investment strategies from systematic global macro to machine learning to advanced trend-following. To focus on one area that I am working on at the moment, we have recently started applying meta labeling to some of the most established models in the Lynx portfolio. By that, I mean we are using machine learning to predict when a certain model – or class of models – has a relatively higher likelihood to perform well. This is not an entirely new concept, but by using alternative data as features we are seeing some interesting results; not only identifying market regimes but also predicting beneficial and detrimental market conditions.

What datasets do you currently find particularly interesting to research?

I work primarily with alternative data and one of my responsibilities is to scout for new alternative data sources. This poses an interesting challenge because the alternative data space is so large and fragmented. We currently observe a lot of changes in this space, driven by existing data vendors consolidating and interesting new entrants to the business. This is why we are continuously evaluating new datasets and data vendors. Speaking of specific datasets, at the moment I am working a lot on those that can be used to forecast macro variables in real time and measures of capital flows.

Where do you see the most promising opportunities to generate alpha in the current market environment?

The biggest market drivers of 2022 were the resurgence of inflation and the Russian invasion of Ukraine. This combination created a market environment that was extremely favorable for many trend followers and macro funds. In 2022, we also saw an aggressive tightening of monetary policy by central banks, which looks likely to continue in 2023. The full effects of higher interest rates on financial conditions will take time to play out. Therefore, it is worth keeping our eyes on global inflation, especially the potential for policy over-/undershooting due to these lags.

Additionally, we expect more volatility going forward. After the Global Financial Crisis and throughout most of the following decade, inflation and economic growth were moderate. Global central banks could stimulate the economy in response to deflationary economic shocks without having to worry about the inflation side of their mandate. Now that inflation is appearing to a degree not seen since the late 1970s, the “Fed put” (and others) could find itself out of style. This could lead to markets having higher volatility than in the prior generation and could result in better opportunities for funds like ours.

Disclaimer

SigTech is not responsible for, and expressly disclaims all liability for, damages of any kind arising out of use, reference to, or reliance on such information. While the speaker makes every effort to present accurate and reliable information, SigTech does not endorse, approve, or certify such information, nor does it guarantee the accuracy, completeness, efficacy, timeliness, or correct sequencing of such information. All presentations represent the opinions of the speaker and do not represent the position or the opinion of SigTech or its affiliates.