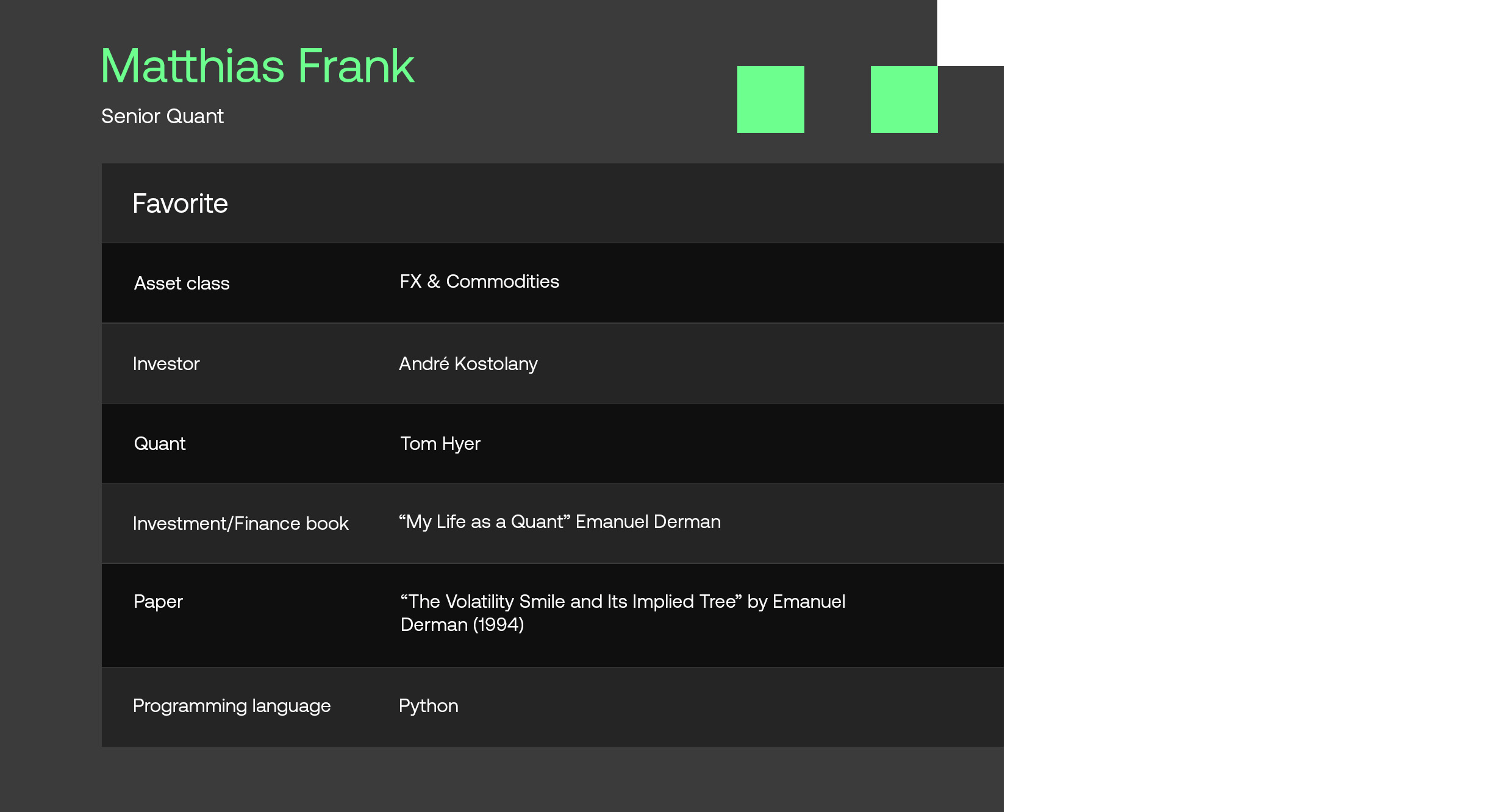

In this month’s edition of SigView, we are pleased to gain insights from Matthias Frank. Matthias currently holds the position of a senior quant at the hedge fund powerhouse Brevan Howard. In the interview, he shares his perspectives on topics like his core principles for constructing quant models, what’s currently at the forefront of his research agenda, and the anticipated impact of AI on the hedge fund industry. Additionally, he discusses his views on the most interesting alpha opportunities.

We trust you will find the conversation enjoyable!

Tell us about your background as a quant.

I have been passionate about investing since I was a teenager and gained my initial experience in quant finance while programming a computer game for stock trading back in the late 90s. The game I initially played had several flaws in price and index computation, which triggered the idea to create a more realistic and accurate version. I ended up using Turbo Pascal as the programming language and learned a great deal about the basics of financial markets and quantitative trading in the process.

I further “quantified” my approach to investing at a probability theory course while studying mathematics at university. After graduating, I landed my first job as a derivatives quant at UBS Investment Bank. In this role, I focused on FX and Equity derivatives in the front office and model validation group, where I gained experience in developing and validating quant models.

I then moved to the buy-side with Brevan Howard, where I transitioned into what can be referred to as a “strategy quant”. In this role, I had a mixture of responsibilities including research, quant development, technology, and trading various macro-related systematic strategies. Following that, I became a founding partner at SigTech, where I assumed leadership roles in quant development, data and cloud engineering. Presently, I have returned to Brevan Howard, where I am specialized in the construction and execution of systematic strategies, as well as conducting research into semi-systematic macro strategies.

Tell us about Brevan Howard.

Brevan Howard is a leading global alternative investment manager, offering institutional investors access to diversified strategies rooted in its edge – macro thinking, trade structuring and risk management. The firm manages over $33 billion in assets for institutional investors worldwide, including sovereign wealth funds, corporate and public pension plans, foundations, and endowments. Brevan Howard has approximately 1,000 team members, representing more than 40 nationalities, located in offices around the world.

What investment strategies do you manage?

I trade long/short semi-systematic macro strategies using futures and swaps across all major asset classes. The trading signals I apply primarily operate at a slow-to-medium frequency, which means that daily, rather than intra-day, trading is typically sufficient. The underlying investment process consists of several layers, where various systematic models are combined with varying degrees of top-down discretionary input.

What are your core principles when building quant models? What makes them unique?

I believe the cornerstone of building any quant model lies in ensuring that the data used is clean and validated. If this initial step is not executed correctly, everything else becomes inconsequential. As I move into the development phase, it comes as no surprise that I adhere to a highly structured process. Among other facets, my approach centers on incorporating unit and integration tests, along with reusable code blocks. This is done to ensure comprehensive testing, efficient maintenance and further development of the models.

Naturally, I also conduct backtests to evaluate my research and quant models. However, I want to emphasize that I firmly believe that excessive reliance on backtests should be avoided. It is essential to define a prior before you run your empirical analysis and to complement backtests with out-of-sample testing. This approach should hopefully improve the models’ robustness.

Moreover, the underlying liquidity of the instruments I trade is important. I only include instruments in my research that provide sufficient liquidity, allowing for trading without incurring significant slippage.

Lastly, I am a firm advocate for prioritizing simpler algorithms with known drawbacks over complex and less comprehensible ones.

What is currently on top of your research agenda?

At the moment, my main research efforts are directed towards exploring different asset allocation and optimization methodologies. These approaches are challenging since adding non-standard constraints like drawdown or stress scenarios make the optimization problem non-convex and often unstable.

What is your take on AI and machine learning and how it will impact the hedge fund industry?

The recent advancements with tools like GitHub Copilot and ChatGPT are true game-changers for quant developers. They enable a substantial boost in productivity by automating a significant portion of coding tasks. The tools guide developers about 95% of the way, leaving them with more time to address specific and often more sophisticated challenges.

In terms of AI, I believe that the intricate nature of financial markets implies that AI-driven research will remain pivotal in the pursuit of new sources of alpha. However, even as automation progresses, the symbiotic coexistence of discretionary and systematic traders, or the interaction between man and machine, will continue to be key. To keep their competitive edge, the quantification of the industry forces all traders to expand their skills to include the latest developments programming, AI and quant technologies in general.

What are the key challenges you face in your day-to-day operations developing and maintaining quant models?

With the risk of being repetitive, the primary challenge lies in ensuring the quality of data. While the identification of problematic data during live production runs is evident, it is vital to establish resilient and exhaustive data quality checks at every stage of the investment process.

Equally crucial, though often less apparent, is the need to ensure that data used in backtests was genuinely available during those times. This requires a clear separation between reference date and publication date within the data infrastructure.

Another significant challenge involves recognizing regime shifts when models cease to operate effectively and how to respond to these shifts.

Where do you see the most promising opportunities to generate alpha in the current market environment?

I currently see significant potential for alpha generation in cross-asset high-frequency momentum strategies. Propelled by advancements in computational power and an ever-increasing availability of real-time market data, these strategies can effectively exploit market inefficiencies. Furthermore, I believe applying this approach to many different assets will be key to providing true portfolio diversification to institutional investors over the next couple of years.

What resources do you recommend for staying informed about the latest advancements in quantitative finance?

I recommend listening to the podcast Top Traders Unplugged, which offers insightful and in-depth discussions with traders and investment managers. Additionally, attending the annual MathFinance Conference is highly recommended. The conference brings together practitioners and academics to present and discuss cutting-edge research and practical applications. It always gives me a handful of valuable research ideas to take back home.

Disclaimer

Sig Technologies Limited (SigTech) is not responsible for, and expressly disclaims all liability for, damages of any kind arising out of use, reference to, or reliance on such information. While the speaker makes every effort to present accurate and reliable information, SigTech does not endorse, approve, or certify such information, nor does it guarantee the accuracy, completeness, efficacy, timeliness, or correct sequencing of such information. All presentations represent the opinions of the speaker and do not represent the position or the opinion of SigTech or its affiliates.