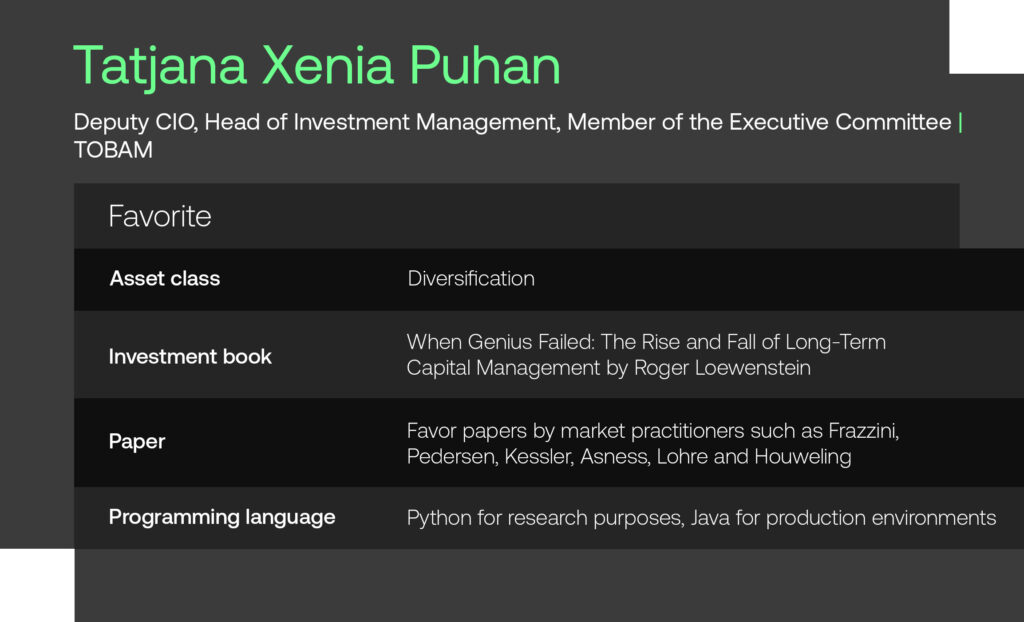

In this edition of SigView we have the pleasure of getting insights from Tatjana Xenia Puhan. Tatjana is deputy CIO, and heads up the research and portfolio management activities at the $6bn global asset manager TOBAM. In the interview she shares insights into the unique portfolio construction methodology that is at the core of TOBAM’s investment philosophy, as well her latest research around how to mitigate risks associated with authoritarian regimes.

We hope you enjoy the conversation!

Tell us about your background as a quant.

I did my PhD in Finance, focusing on research to better understand asset prices in financial markets and how corporations make decisions. This led me to study predictive patterns in option markets, factor models, cash holdings of companies, and investment decisions in the context of a changing macroeconomic environment. I also spent two years conducting behavioral finance experiments.

In my first job after completing my PhD I was a quant PM. I managed equity, multi asset and liquid alternatives portfolios and contributed to quantitative research for the models used to run the portfolios. This is essentially what I still focus on, even though I am not actively trading anymore. I also spend a significant amount of time talking to investors, trying to understand their problems and how we can provide solutions for them.

Tell us about TOBAM.

TOBAM is a quantitative asset manager with a global footprint. Our team is extremely diverse and located across the three main locations of Paris, Dublin and New York. Almost half of TOBAM’s staff is involved in portfolio management and research. This is a significant number highlighting our commitment to be a nimble and lean organization which puts its resources where the ‘investment engine’ is. This is essentially what our clients pay for. We invest in equities, fixed income, multi asset and crypto portfolios. Our flagship strategy aims to maximize the diversification of a portfolio.

What investment strategies do you manage?

As Head of Investment Management, I oversee all of Tobam’s portfolio management and research activities. We run a large number of global and regional equity as well as global fixed income (investment grade and high yield) strategies. These complement our dedicated multi-asset and crypto expertise. We recently launched strategies that feature downside protection through either option overlays or dynamic allocation models.

What are your core principles when building quant models? What makes them unique?

At the core of our investment philosophy is the maximization of the so-called “Diversification Ratio”. You can read about it in our founder’s 2008 Journal of Portfolio Management article (Choueifaty et al. 2008, Towards maximum diversification). The investment process is patented, which is quite unique in the investment management industry.

As a pioneer in the field of smart beta, our original idea was to create a portfolio that came much closer to the true market portfolio than the traditional market capitalization-weighted (MCAP) index. The goal was to construct a portfolio without the bias exhibited by most MCAP indices; one that was truly diversified. To this end, a measure was developed that allowed us to distinguish the degree of diversification of different investment portfolios with mathematical precision.

Over the long-term, collecting premia related to as many independent sources of risk as possible should lead to better risk adjusted returns compared to taking larger single bets that oftentimes fall very quickly and very deeply before they mean revert.

What is currently at the top of your research agenda?

Over the past 12 months, our research team has worked very intensely on a topic that seemed to be a non-issue for the previous 15 years: the risk associated with authoritarian regimes. My generation had only ever experienced an environment characterized by steady improvement and an opening of financial markets and economies. Consequently, most investors ignored this kind of risk. With the recent rising of geopolitical tensions around the globe and, in what seems like, a mean reversion in global openness, this topic is again a key concern for many asset allocators. Yet, few know how they can integrate this risk framework into their investment portfolios.

We found a novel way to measure the risk arising from authoritarian regimes and to build portfolios that effectively mitigate it.

What is your take on alternative data and its future potential impact on the investment management industry?

The potential of alternative data is undisputed and we are certainly investigating how to best make use of it. However, one also needs to be mindful of the potential pitfalls involved with using such datasets. It is important that we understand exactly how much error and noise any specific dataset is expected to have and how to effectively account for this before we start using it. Just because you know how to use Google News or Twitter API, does not mean you have found something that is useful for making investment decisions.

What are the key challenges you see investors facing in their day-to-day operations when developing and maintaining quant models?

The quality of data is key and we spend a lot of time searching for potential data quality issues and solving them with their respective data providers. Sometimes we feel like we do their job for them!

Also, accessing data with a long history is often difficult. However, I think it is oftentimes unclear whether a very long history is actually helpful.

Finally, the end of a research project is often the beginning of the 2.0 project. At TOBAM we have so many smart people that we never run out of ideas on how to improve something or challenge the status quo. The challenge is deciding about what research projects to prioritize.

Where do you see the most promising opportunities to generate alpha in the current market environment?

TOBAM is not about generating alpha, we are about providing true beta. So I leave the response to this question to someone else.

Disclaimer

Sig Technologies Limited (SigTech) is not responsible for, and expressly disclaims all liability for, damages of any kind arising out of use, reference to, or reliance on such information. While the speaker makes every effort to present accurate and reliable information, SigTech does not endorse, approve, or certify such information, nor does it guarantee the accuracy, completeness, efficacy, timeliness, or correct sequencing of such information. All presentations represent the opinions of the speaker and do not represent the position or the opinion of SigTech or its affiliates.