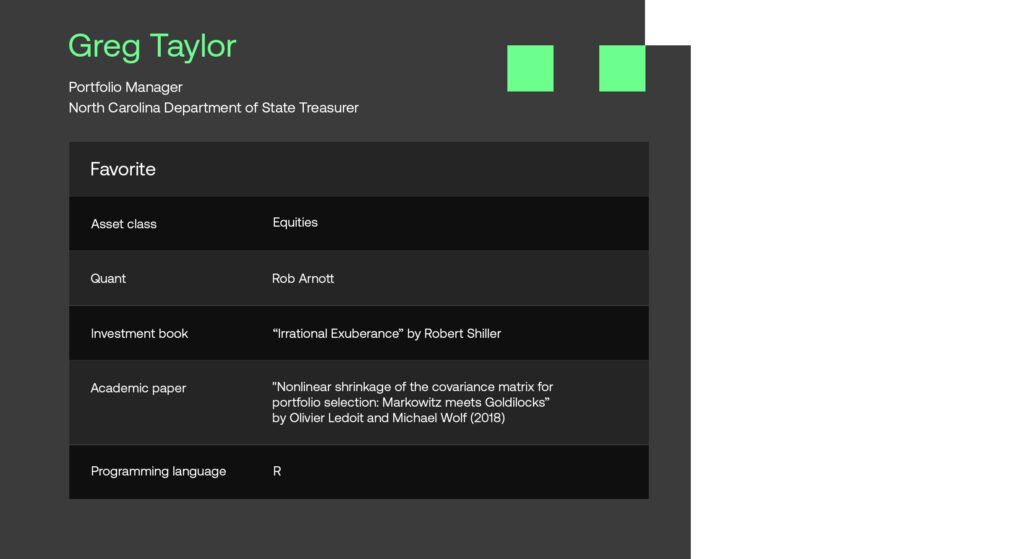

In this month’s edition of SigView, we are delving deeply into the influence of systematic investing on a large pension fund in North America. We had the privilege of engaging in a conversation with Greg Taylor, a portfolio manager at the North Carolina Retirement Systems (AuM $120bn). The interview provides insights into his fundamental principles and main challenges encountered in constructing quantitative models and the current focus of his research endeavors. Naturally, we also queried him regarding his perspectives on the most compelling opportunities to uncover alpha.

We trust you will find this conversation engaging and insightful.

Tell us about your background as a quant.

After a brief period in wealth management, I went back to university to complete a master’s degree in finance, focusing on investment management and quantitative finance. Following this, I worked for an infrastructure and engineering consultancy as an economist, where I provided econometric and financial analytics for large-scale infrastructure projects. I then transitioned into investment management to my current role as a portfolio manager on the public equity team at the North Carolina Retirement Systems which in total manages around $120bn on behalf of current and retired state employees.

What investment strategies do you manage?

I am currently responsible for three internally managed US equity portfolios, as well as the oversight of several externally managed equity strategies. Among the internal portfolios, two are managed to track externally provided custom indices. The third, and most recent, is our internally developed core factor portfolio, which we launched in early 2022 after years of thorough research. Rooted in our findings that demonstrate factor resilience throughout full market cycles, this portfolio is tilted towards the value, quality and momentum risk premia.

What are your core principles when building quant models?

My overarching philosophy is to maintain simplicity and intuitiveness. I believe this enhances model robustness and prevents unintentional and less comprehensible portfolio exposures. Moreover, adopting the perspective of our total portfolio, this approach helps me to better understand its risks and return drivers. For example, when deciding on how frequently to rebalance our internally managed equity strategies, I found that sticking to a quarterly frequency helped manage turnover without much impact to our factor exposures compared to a more frequent, higher turnover process.

Furthermore, I believe it’s crucial to employ insights supported by academic research when constructing quant models. In the risk factor strategies I oversee, there exists a wealth of research corroborating the presence of risk premia in areas like value, quality, and momentum. Our fund’s long-term investment horizon enables us to emphasize such strategies that we anticipate will outperform throughout full market cycles.

What is currently on top of your research agenda?

My present primary research project involves developing a framework that utilizes factor risk models to enhance the accuracy and efficiency of modelling correlation structures. The project also includes trying to reduce the tracking risk of the custom index portfolios I run. This is done by leveraging our access to third-party risk models and software and integrating them into our proprietary in-house models.

Another subject I am currently working on is concentration risk, which is typically quite pronounced in market capitalization-weighted indices. I am exploring systematic approaches to enhance portfolio diversification without incurring excessive idiosyncratic relative risk. Given the high concentration in numerous US equity indices, such as the Russell 1000 where the top 10 companies comprise around 30% of the index, and our fund’s substantial exposure to these stocks in other parts of the portfolio, I am examining methods to improve the diversification of our factor portfolio.

This could involve implementing straightforward approaches like setting maximum position weights or capping individual active risk contributions. The objective is to gain a deeper understanding of how each of these potential constraints influences the overall portfolio exposures and to identify any significant unintended consequences.

What are the key challenges you face in your day-to-day operations developing and maintaining quant models?

The main challenge I encounter involves accessing validated and clean data that doesn’t demand extensive upfront work to become operationally ready. While there’s a growing availability of new and intriguing datasets, I believe a significant disparity still often exists between our expectations as data users and the accessibility provided by data vendors.

An additional challenge I encounter is resource allocation while operating within a constrained budget. As a streamlined organization, we try to maximize our efficiency by accessing tools like portfolio optimization and risk models offered by third-party service providers. This approach allows us to attain optimal value for our fund’s members within our financial limitations.

The final point I’d like to highlight has to do with a behavioral aspect, specifically the significance of maintaining objectivity and having faith in your investment process. Even long-term highly successful investment strategies can, or rather will, experience brief spells of underperformance. It is during these phases that exercising patience and adhering to our core investment principles becomes essential. But sometimes this is easier said than done.

Where do you see the most promising opportunities to generate alpha in the current market environment?

I tend to focus on medium to longer-term opportunities, and my core philosophy revolves around steering clear of market segments that are overhyped and consequently often overbought. Instead, my focus is more on identifying opportunities in beaten-down segments. I consider this an approach where systematic strategies excel in capturing and compounding incremental alpha over time. In the first half of 2023, we benefited from being overweight in certain higher-quality and less expensive technology and communication services companies that were adversely affected by the market sell-off last year.

What resources do you recommend for staying informed about the latest advancements in quantitative finance?

There are quite a few quant investment managers who publish valuable research and insights about the latest advancements in quantitative investing. I especially enjoy reading pieces from Acadian Asset Management and AQR.

Disclaimer

Sig Technologies Limited (SigTech) is not responsible for, and expressly disclaims all liability for, damages of any kind arising out of use, reference to, or reliance on such information. While the speaker makes every effort to present accurate and reliable information, SigTech does not endorse, approve, or certify such information, nor does it guarantee the accuracy, completeness, efficacy, timeliness, or correct sequencing of such information. All presentations represent the opinions of the speaker and do not represent the position or the opinion of SigTech or its affiliates.