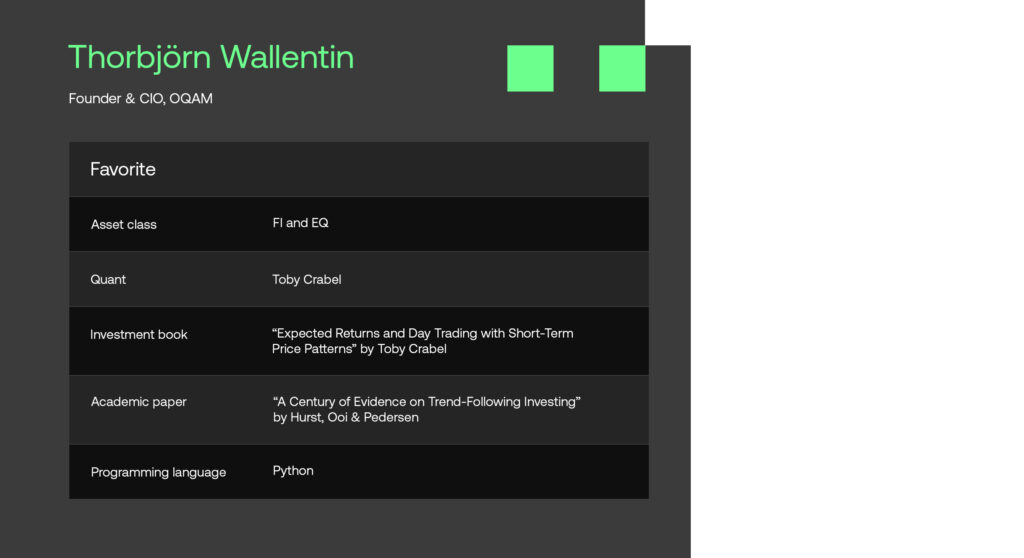

In the latest edition of SigView, we have the privilege of engaging in a discussion with Thorbjörn Wallentin, the founder and CIO of the quantitative asset management firm OQAM. In the interview, he talks about how his passion for poker and mathematics acted as a catalyst for his fascination with applying a systematic approach to investing. He also shares his perspectives on the optimal methods for constructing quant models, underscoring not only the best practices but also the pitfalls to steer clear of. Furthermore, he provides insights into his current research agenda and what impact his close collaboration with academia has on developing OQAM.

We trust you will find the conversation insightful.

Tell us about your background as a quant.

My interest in investing was sparked during my early teens, leading me to start trading small- and mid-cap stocks at the age of 14. However, fueled by a passion for mathematics, I found the more quantitative aspects of investing to be more appealing.

During my university studies, I pursued poker at a professional level, but the prospect of a finance career was ultimately more compelling. After completing my degree in engineering physics, I joined Nordea as a quantitative proprietary trader. I started just one week before the Lehman Brothers bankruptcy, a period I often characterize as “learning by burning.”

At Nordea, my initial focus revolved around developing and implementing proprietary systematic cross-asset models that traded liquid futures with a primary focus on short-term trading, trend, and carry strategies. One of the great privileges of working within a banking giant such as Nordea was the exposure to leading hedge funds like Man, Lynx, and Crabel. They would pitch their funds to our internal hedge fund allocation team and I could join those meetings and get invaluable insights. Attending those meetings was like Christmas and my birthday rolled into one.

Post the Global Financial Crisis, Nordea established a new asset & liability management group. Here, in addition to applying my systematic models, I began embracing discretionary investing. This pivot was invaluable for my development as a quant, as it gave me a more comprehensive understanding of macro trading. Within this role, I undertook responsibility for various investment mandates. These included co-management of different strategic risk mandates, and direct responsibility of various fixed-income mandates—such as deposit hedging, Nordea’s liquidity buffers and pledge collateral portfolios in the Nordic currencies (> EUR 20bn) — and the responsibility of a EUR 3bn cross-asset mandate for Nordea’s employee pension foundation.

In 2015, I finally followed my dream, in part fueled by reading Jack Schwager’s classic book “Market Wizards” while completing my master’s thesis, and co-founded OQAM alongside Andreas Olsson. The transition from a large bank environment to a startup proved to be a steep learning curve, but it stands as the most impactful and rewarding professional decision I’ve ever made.

Tell us about OQAM.

We founded OQAM in 2015, and as a Swedish-based asset management firm, it has gained recognition for its extensive integration of technology in both the development and execution of investment strategies. Our commitment lies in offering our clients seamless access to our strategies and platform, complete with tailor-made investment strategies and analytical tools. Moreover, we extend our services by providing investment guidance based with insightful analytics spanning a multi-asset class framework.

What investment strategies do you manage?

I am focusing most of my time on developing and managing absolute return-focused multi-asset class strategies. As a carve-out from our multi-strategy fund ia, we are currently in the process of implementing a systematic short-term trading strategy in a stand-alone fund structure. The strategy trades around 20 liquid futures and FX pairs and the average holding period is below one day.

In addition, in partnership with one of OQAM’s shareholders, we recently launched a fixed income credit fund, mainly focusing on the Nordic BBB-segment. The shareholder is a large single family office that outsourced their credit portfolio to our fund.

We are also in the process of setting up customized white label solutions for trend-following and asset allocation strategies for professional investors and other financial institutions.

What are your core principles when building quant models? What makes them unique?

At OQAM, our approach to research and investing revolves around a quantamental and data-informed foundation. I am a firm believer that harnessing the power of systematic models and eliminating human biases serves as the optimal means to unlock the full potential of quant strategies.

Additionally, recognizing that financial markets are inherently dynamic rather than static, I hold the conviction that continual adaptation and iteration – essentially applying a dynamic and innovative investment approach – form the cornerstone of achieving long-term investment success. An example of this belief is my dedicated focus on market regime identification.

With regard to our strategies’ overarching investment objectives, we place considerable emphasis on two key pillars: capital preservation and long-term compounding, both contributing to achieving attractive risk-adjusted returns. This objective stands true whether viewed as a standalone investment strategy or within the broader context of an investor’s portfolio. In the capacity of a single investment strategy, we aim for it to generate an attractive return in as many various market regimes as possible, to provide excess returns in the periods where investors need it the most (for instance during times of financial stress), and to compound returns during longer uptrends. This is accomplished by combining models that exhibit unique strengths and weaknesses across various market regimes and by executing sub-strategies that diversify across various time frames, asset classes and financial instruments globally.

As a final point, I firmly advocate for embedding a comprehensive risk management framework that spans every phase of the investment process. While achieving absolute preparedness for all potential scenarios may be unrealistic, we proactively prepare for those scenarios that could inflict the most damage upon our strategies.

What is currently at the top of your research agenda?

At present, my focus centers on improving existing and adding diversifying sub-models that center around short-term trading strategies. I among others try to get a better understanding on how crowding in managed futures impacts short-term price movements.

Furthermore, partly through our collaboration with academia, I am delving into refining the definition of distinct market regimes at a more nuanced level, while still being a firm believer in simplicity and relying on as few assumptions as possible. In addition, I am engaged in enhancing our asset allocation framework to allow for an even more efficient customization, catering precisely to specific risk-return profiles.

Tell us about your and OQAM’s collaboration with academia.

I believe there is often too significant of a gap between academia and the professional world. Keeping this in mind, ever since the inception of OQAM, we have actively pursued collaborations with the local university in Lund (Sweden) and their departments of mathematics and statistics. This approach allows students to gain firsthand experience in the finance industry, while also providing us with valuable insights that contribute to our research projects.

As a standard practice, we have a number of interns and students engaged in part-time roles, supporting our ongoing operations or contributing to specific research projects. Personally, I am regularly involved in supervising students as they work on their bachelor’s or master’s theses. These projects have recently spanned a range of topics, including natural language processing, machine learning-based regime shift models, and the utilization of alternative data for stock selection.

Lastly, I want to highlight that this collaboration has proven to be an excellent talent pool for hiring new team members.

What are the key challenges you face in their day-to-day operations when developing and maintaining quant models?

As a smaller asset manager, the effective management of limited resources and their optimal allocation remains an ongoing challenge. In terms of workflows, sourcing high-quality and attractive data, and getting it operationally-ready, is an area where I see a considerable disconnect between data users’ expectations and data providers’ offerings.

Furthermore, I believe a key challenge is to speed up the transition from research to development and live implementation, alongside streamlining the process of efficient order execution.

Internally, I’ve invested substantial time and effort into constructing and enhancing diverse dashboards utilizing Python. These dashboards serve the purpose of giving all team members and selective clients access to real-time portfolio analytics, spanning facets such as execution, slippage, market regimes, performance, and return attribution.

Finally, circling back to the challenge posed by our limited resources, making use of various AI tools have notably amplified productivity for specific segments of my workflow.

Where do you see the most promising opportunities to generate alpha in the current market environment?

As a general theme, I am of the opinion that macro trading currently presents the most promising avenues for generating alpha. The intricate landscape involving central banks’ efforts to normalize their balance sheets while grappling with persistent high inflation figures is poised to sustain opportunities across fixed income, credit, and equity markets.

At a certain juncture, I foresee the appeal of small-cap growth and quality stocks resurfacing. When the trajectory of interest rates and inflation aligns favorably – likely coinciding with an upswing in unemployment figures – stock picking is bound to again offer many attractive opportunities. But I don’t need to capture the first 5-10% upward movement as I find it more important to mitigate downside risks.

Moreover, as an “evergreen”, financial markets characterized by lower competition and where specialized expertise is indispensable always remain interesting. Examples include niches such as fixed income and small- and mid-cap stocks within smaller, less liquid markets.

What resources do you recommend for staying informed about the latest advancements in quantitative finance?

I find great value in tuning into podcasts like “Flirting with Models” and “Top Traders Unplugged” for firsthand insights from quants, traders, and portfolio managers. Alongside this, I suggest keeping an eye on quant asset managers and hedge funds like Two Sigma and Man Group, which often share insightful research. For a more dynamic, albeit slightly chaotic, stream of information, X (Twitter) serves as an excellent platform where highly skilled professionals share pertinent insights and interesting research papers. I particularly recommend following @quantseeker, who acts as a valuable filter by sharing a curated selection of quant-related papers.

Additionally, though it might seem old-school in today’s digital age, I firmly believe that books remain an exceptional source of knowledge and inspiration. At our end, we maintain a thoughtfully curated “best of” list that spans various domains, encompassing everything from short-term trading strategies and behavioral finance to entrepreneurship, machine learning, artificial intelligence, and beyond. If you’re interested, don’t hesitate to reach out to me; I’d be more than happy to share this list with you.

Disclaimer

Sig Technologies Limited (SigTech) is not responsible for, and expressly disclaims all liability for, damages of any kind arising out of use, reference to, or reliance on such information. While the speaker makes every effort to present accurate and reliable information, SigTech does not endorse, approve, or certify such information, nor does it guarantee the accuracy, completeness, efficacy, timeliness, or correct sequencing of such information. All presentations represent the opinions of the speaker and do not represent the position or the opinion of SigTech or its affiliates.